Transitioning to a new firm?

START THE NEXT CHAPTER WITH THE RIGHT FIRM

Transitioning with the Financial Advisor Flight Plan: DOWNLOAD OUR COMPLETE GUIDEBOOK

What is contained in this Guidebook:

- What's Your Situation?

- What Financial Advisors Want

- What Clients Want

- What Happens if I Stay the Course?

- When is it Time to Explore Other Options?

- Who Benefits and How? (Ideal Firm Profile)

- What Else? (How to Evaluate a Firm)

- What to Expect as You Explore Your Options

- The Advisor Flight Plan

- Pre-Flight Activities

- Arrival Activities

- Is Now the Right Time to Explore Your Options?

Content and strategies provided in collaboration with

Even if you're years away from thinking about making a move or may never move at all, the team at Diamond Consultants can help. If your goal is to ultimately maximize the value of the business you've built, or to serve clients better, you want to ensure you are best positioned to do so. Schedule time to speak with the Diamond Consultants leadership team confidentially, and at no cost or obligation to you.

SPEAK WITH US

WHAT'S YOUR SITUATION?

Do you feel you are in a good place with your current firm - or do you feel that you may have outgrown them?

Could your clients be better served somewhere else? Do you want greater autonomy, a wider range of services, and the ability to provide an exceptional client experience?

If you are asking these questions, you are not alone. Many advisors find themselves wondering what their route forward should be. This guide is a first step toward taking control of your professional destiny. In it, we'll explore your options, outline what the transition process should look like, and help you provide clarity on the current state of your business. By the end, you'll be able to make informed decisions and embark on a new chapter of professional growth and fulfillment.

The Challenge of Constraints

Many financial advisors know that their clients would benefit from a broader range of services and a more comprehensive approach but feel restricted by compliance rules, limited product offerings, or firm policies. This sense of being tied down can stifle ambition and prevent advisors from delivering the elevated client experience they envision.

Key Questions for Advisors

- Growth Potential: Are you able to grow and scale your business in your current environment?

- Exploring Options: What are the options available for advisors looking to break free and achieve more?

- Ensuring a Smooth Transition: What does a transition look like?

- Continued Growth: Once the transition is complete, how do you continue to scale your business?

Overcoming Complacency and Fear

Growth-minded financial advisors often reach a tipping point. Success can breed complacency, and a fear of disruption can paralyze even the most ambitious professionals. This guide explores common excuses advisors use to justify "staying put' despite underlying dissatisfaction. By recognizing these self-imposed limitations, advisors can break free from the status quo.

Transitioning from Passive to Proactive

The goal of this document is to help advisors transition from passive participants in their careers to active navigators of their professional destinies. Whether driven by reactive frustration or proactive ambition, breaking free from complacency is challenging. Advisors must evaluate their reasons for "staying put' to make informed decisions about their careers.

Some financial advisors are not willing to wait to achieve their vision of excellence; instead, they want to find the fastest and most efficient path to get there. So how do you determine the path? Start by examining what you and your clients want.

WHAT DOES EVERYONE WANT?

WHAT ADVISORS WANT

As financial advisors adapt to changing client demands and industry dynamics, they are prioritizing several key areas:

- Innovative services that go beyond investments - Such as tax advisory, estate planning, and lifestyle services - to offer a comprehensive approach.

- Unique branding and scalable digital communications - Creating personalized brands and utilizing social media to connect with clients.

- Culture is important too - Their values need to align with the firm.

- Ease of doing business - They dislike excessive red tape.

- Client experience is crucial with advisors demanding competitive technology that offers a seamless experience without pressures to cross-sell products or restrictions on account types.

- Save their entrepreneurial spirit - Advisors are looking for ownership opportunities that allow for inorganic growth and succession planning. Advisors want to feel energized by their work and build a meaningful legacy.

- Finally, economics matter as advisors seek a fair share of the revenue they generate and sufficient value from their firm.

WHAT CLIENTS WANT

Clients now expect more from their advisors than just trustworthiness, competency, responsiveness, and mutual respect. They seek:

- An Elevated client experience - A relationship that truly puts them front and center.

- Comprehensive services - That include access to alternative investments, tax preparation, estate planning, lending, insurance, and other bespoke services based on their needs.

- Modern technology platforms - Easy access to accounts and reports.

- Flexible fee structures - They seek value; service and advice that aligns with what they pay.

WHAT HAPPENS IF I STAY THE COURSE?

Although maintaining the status quo might seem safe, the pivotal question remains "Why?" More specifically, "Why choose to stick with the status quo instead of considering change?"

First, assess the level of "pain" you're in. Not all things that frustrate you are created equal. Some are minor annoyances that can - and should - be easily worked through. Others, whether individually or in combination, might be much more intolerable. The latter are most likely to motivate you to consider change because change is hard, and following the path of least resistance can seem easier until irritation rises to the level of obstruction.

Second, are you suppressing your growth possibilities? While staying at a familiar firm may seem safer, it carries risks that many advisors overlook. Financial advisors often tolerate issues because the situation seems "good enough," and the fear of change is strong, but this complacency can have unintended consequences. You can stagnate your growth, burn out your staff, add stress to relationships, reduce your enterprise value, and (worst of all) frustrate your clients.

WHEN IS IT TIME TO EXPLORE OTHER OPTIONS?

Many advisors express a common sentiment: "I am happy, but could there be something better? What am I missing?" This uncertainty reflects a struggle between considering change and remaining loyal to their firm, often without defining clear goals/p>

Advisors must ask the tough question: Am I truly happy? Happiness is relative and connected to fulfilling goals. Here are some personal questions to ask yourself:

- Do I feel my firm's platform, support, and infrastructure are robust enough?

- Am I getting enough value from what my firm delivers?

- Do I feel optimistic about my prospects for growth?

- Do I feel limited in any way, and how might those limitations be impacting productivity and client service?

- What are my long-term business goals?

- What additional products or services would I like to offer clients, and can I satisfy those needs where I am?

- If I had a blank slate, what would my version of perfection look like in five or ten years?

- What future developments might further tie me to my firm?

- What are my succession goals, and does my firm have a competitive retire-in-place program?

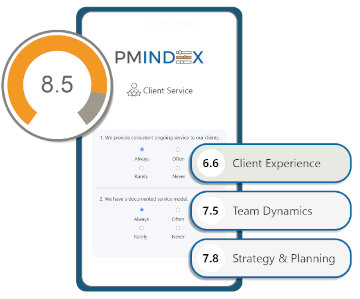

Thinking about change can be overwhelming, but when you add in the multitude of options advisors have today, it's enough to stop many teams in their tracks. That's why Diamond Consultants created its "Defining Your Best Business Life" Self-assessment to arm advisors with the right strategic questions they should ask themselves before jumping into action. These questions help to clarify goals and ultimately focus a due diligence process on the right options, saving time and energy.

TAKE OUR TRANSITION ASSESSMENT

BUILD YOUR IDEAL FIRM PROFILE: WHO BENEFITS AND HOW?

Before making a move, advisors must ask this question: What's in it for me and my clients? Below are the criteria to build your Ideal Firm Profile so that you can make an informed decision before any move:

- Enhanced Support

- Responsive personalized service

- Excellent support staff

- Support resources

- Administrative services

- Greater Investment Flexibility

- Personalized portfolios

- Models vs holdings

- Broader platforms and sophisticated alternatives

- Vetted managers and solutions

- Comprehensive Services

- Client-centered experience

- Panoramic financial advice

- Comprehensive services including tax planning and trusts

- Family office services, etc.

- Reduced Costs

- Lower costs are a clear win for clients

- Pricing on accounts, SMAs, or lending rates

- Office space, staffing, etc.

- Superior Technology

- Better tech experience

- State-of-the-art software and tools

- Sophisticated planning and a seamless client interface

- Reduced Bureaucracy

- Autonomy

- Fewer compliance hurdles

- Compliance oversight

- Improved Communication

- Provide real-time information and responses to clients

- Consistent team meetings

- Strategic planning

- Marketing Support

- Websites

- Social media

- Client events

- Branding

- Growth & Scalability

- Options to partner with like-minded advisors

- Operational efficiencies

- Systems and processes

- Defined roles & responsibilities

- Practice Management

- Culture of best practices

- Internal practice management coaches

- Coaching programs or resources

- Professional Environment

- Inviting office space

- Private office

- Option to work virtually

- Boardrooms that encourage team collaboration

- Alignment & Fit

- Personal relationship fit

- Cultural fit

- Philosophical fit

- Other?

HOW TO EVALUATE A FIRM BEYOND THE OBVIOUS. WHAT ELSE?

When reviewing firms, many financial advisors find that multiple options can meet their basic requirements and their Ideal Firm Profile. So how does an advisor determine the best fit for their unique needs? Selecting the right firm is more art than science, but considering these additional factors can help prioritize the top contenders:

- Client/Book Ownership: Understand the firm's policy regarding client relationships. Some firms explicitly claim ownership of the client book, while others allow advisors to retain ownership.

- Mutual Interest: Even if a firm appears perfect on paper, lukewarm interest from them may indicate you're better off elsewhere. Gauge the firm's interest in you during the recruiting process; pay attention to subtle cues like responsiveness and how they treat you.

- Succession Planning: With many advisors approaching retirement, succession planning is essential. Does the firm provide retire-in-place or sunset programs? Can you find an in-house successor if necessary?

- Multiple Affiliation Channels: Some firms offer both W-2 and independent channels. Can you transition between these channels if it benefits you and your clients?

- Future Economic Considerations: Beyond the initial transition deal, explore other monetization avenues such as partnership equity or paths to more significant economic benefits.

- Referral and Growth Mechanisms: Growth is a priority for most advisors. Some firms provide referral programs from investment banks, CPAs, and commercial or retail banks or opportunities to acquire books of business.

- Future Ownership of the Firm: Consider the firm's future prospects, such as potential acquisitions, going public, or other transactions.

- Operational Excellence: Evaluate the firm's operational efficiency. Are support teams well-staffed and adequately trained? Is the firm business-friendly and effective in day-to-day operations?

WHAT TO EXPECT AS YOU EXPLORE YOUR OPTIONS

It's probable that when an Advisor is considering making a move, they are speaking to and meeting with more than one firm and/or team and exploring all of their options. That's one of the reasons it's so important to make a professional first impression when it comes to your initial communications with a prospective firm; they will be comparing you and your process to that of others.

You want to stand out for all the right reasons - being more professional, structured, thorough, and organized. If you do, you can favorably demonstrate and communicate your value.

Your first appointment with a prospective firm is typically an exploratory conversation - a "get to know each other." This meeting is intended to share personal and business backgrounds, general motivations, and the goals of both your firms. The objective is to determine an initial level of interest in order to make a preliminary decision to move forward in the process.

You will want to:

- Make an exceptional first impression.

- Establish rapport with a prospective firm's leadership.

- Help them become predisposed to you, your team, and your firm.

- Preemptively ask about potential questions or concerns.

- Determine a mutual alignment of interests.

- Set the stage for a productive professional relationship.

- Decide if it makes sense to move forward in the process.

Your second appointment with the prospective firm may drill down into specifics to determine a mutual fit. You will want to refer back to the criteria you documented within your Ideal Firm Profile to ensure this is a great fit for everyone and the decision-making process is based on accurate information and facts instead of emotion.

You should:

- Continue to establish rapport and build trust with the prospective firm.

- Get an understanding of key business components from your Ideal Firm Profile.

- Clearly articulate how you and your team conduct yourselves and what the firm can expect from you.

- Determine if it makes sense to continue in the process based on what you've learned in this meeting.

Your third appointment could be a discussion on expectations as it relates to roles, operations, marketing, management, compensation, and practice management. It's one thing to agree in principle that you can work together, but it's something entirely different to document in detail how the partnership will function. This is a critical juncture in the fit process, and careful attention should be paid to their willingness to discuss, cooperate, and negotiate to get a balanced, workable agreement in place with you.

You will want to:

- Continue learning more about their working style, communication approach, and personality.

- Clarify expectations in writing of you and your organization - What exactly will they provide to you and vice-versa?

- Discuss key focus areas of the business, including office space & operations, human resources, immersing yourself in their culture, marketing, and technology, etc.

- Begin to outline the terms of the potential deal structure for your future working relationship.

- Assess if you will be able to reach a workable deal with this prospective firm.

The fourth appointment could be a conversation to define the deal structure. This is an opportunity to obtain feedback, answer questions, and make necessary revisions to finalize a Letter of Intent and move toward a final agreement. At this part of the fit process, it will become very clear if this relationship will be moving forward or not. It is important that you continue to pay attention to their manner of communication, level of engagement, ability to cooperate, and willingness to negotiate respectfully.

You will want to:

- Set the stage for timelines and moving forward together in the spirit of mutual interest and enthusiasm.

- Define the client Transition plan - see "The Advisor Flight Plan' on page 14.

- Ensure that you and the prospective firm are comfortable with and understand the deal structure.

- Give you the opportunity to make any corrections or alterations to the recommended deal structure.

- Begin the process of drafting a final contractual agreement.

The fifth appointment will be nearing finalization. At this time, both parties should have absolute confidence in forging ahead based on the time they've taken to carefully explore and understand everything as it relates to their respective business vision, goals, team, clients, processes, philosophies, and expectations.

Assuming everything goes according to plan, the final decisions will be made, the agreement signed, and you will soon progress to the transition using a system such as The Advisor Flight Plan.

THE FINANCIAL ADVISOR FLIGHT PLAN

PREPARING FOR AND EXECUTING ON THE CLIENT TRANSITION

Ensuring a successful transition for both you and your clients is the objective, and preparation will reduce your transition-related anxiety. If there was ever a situation where time is money, this is it.

The Client Transition phase for an advisor is of critical importance because it determines two major factors which contribute directly to the revenues and to the profitability you derive from this relationship: Percentage of client conversion and the speed of asset transfer. This is why it's so important that you flawlessly execute on all the other aspects of your advisor onboarding process, such as your office space, operations, human resources, marketing, and branding, etc.

Advisors need to put their undivided attention into the client transition process. They also need to recognize how intense and stressful this time can be for all parties, which means everything you do to make it easier for yourself will benefit everyone involved - you, your team, the clients, and your new organization.

PRE-FLIGHT ACTIVITIES

- Inform your team - Have clear conversations with your team members (if applicable) regarding the transition.

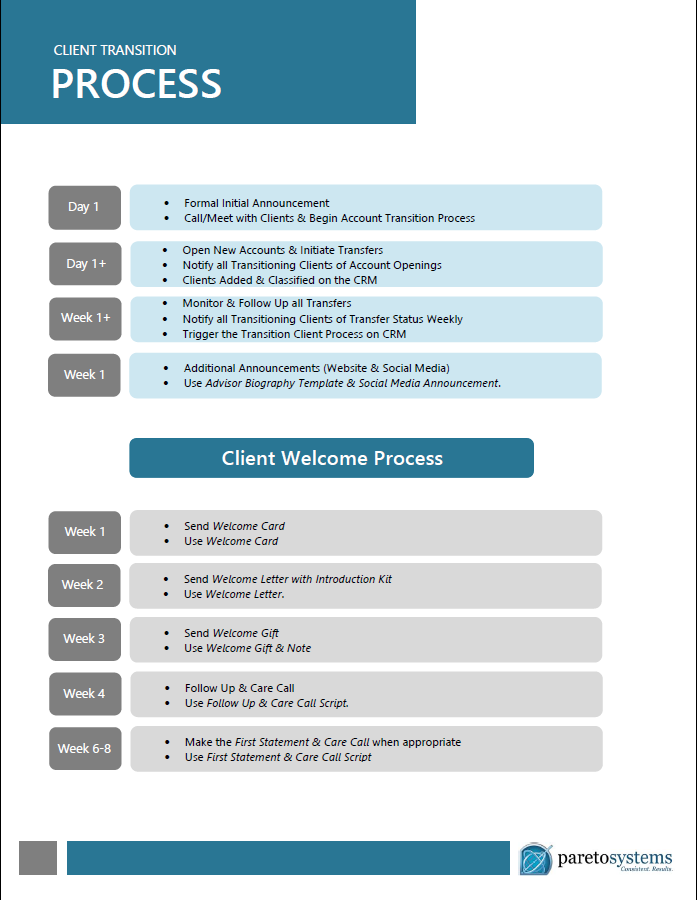

- Work on your overall plan - Define and communicate the transition steps with your team ensuring nothing slips through the cracks. See the "Client Transition Flowchart' on page 16 for more detail.

- Assess your client base through client classification & right-sizing - This is an opportunity to continue working with the clients you actually want to work with. You should have an understanding of which clients are coming with you.

- Define the Client Onboarding experience - You want to welcome your existing clients and ensure they feel like the client experience has been elevated through this transition.

- Clarify the Account Transfer Process - Understand the process, who is responsible, whether it's paper-based or digital. Know the expected timeline for transferring assets and opening accounts.

- Immerse yourself in the technology - Getting comfortable with the technology can ease the transition and reduce stress when you start using the new tools. Tech demos are a good place to start.

- Create your list of key Contacts - Compile a list of important individuals, roles, and responsibilities to ensure you know who to contact as part of each step in the process.

- Prepare Client communication - Work on pre-announcements if appropriate. Develop a plan for contacting clients ensuring compliance with any agreements. Prioritize client communications and focus on positioning the move as a benefit to your clients. This may include phone calls, letters, emails, or meetings.

Below is a sample "Client Transition Letter':

[Date]

Dear Valued Client,

We are excited to announce that we have changed firms to [name of new firm] effective [date]. As our firm continues its impressive growth, we felt we needed to find a strategic partner that is aligned with our philosophy, planning strategy, and process to best serve our clients. After an extensive due diligence process, we felt [name of new firm] was the right fit for us. [Name of new firm] is [list 2-3 reasons for selecting this firm. Examples include:]

- Not transactional or product-focused

- Client-centered with an emphasis on the client experience

- Panoramic with an approach that enables us to put every piece of the financial puzzle together

For our clients, you can expect to be receiving new account paperwork via email in the near future. The new account process should be quite easy with the electronic signature feature available to our clients. It is imperative that you sign the forms quickly so your assets can be transferred from [former name of firm] over to [name of new firm]. We will be unable to service your account until the assets are at [name of new firm].

If you have questions, please call our office. We are grateful to have such wonderful clients, and we thank you for your partnership with us.

Sincerely,

[Advisor's Name]

[Advisor's Title]

This template is designed to help you inform your clients about your move to the new firm. Please adjust it to fit your circumstances and voice. In either event, be aware that you need to obtain compliance (and perhaps other) approval of the contents of the template prior to sending it out to your clients. This template has not been approved by your firm's compliance department. We disclaim any liability thatmay result from the use of this template without first obtaining all necessary compliance or other required approvals. Be aware of your prior firm's terms of employment or contractual agreements.

ARRIVAL ACTIVITIES

Be realistic with your expectations and anticipate some challenges. Understand that not everything will go as planned, but having a strong support system will help you navigate obstacles effectively. By taking these steps, you can ensure a smoother transition and minimize stress. Remember, moving is a process that takes time, and proper preparation can make all the difference.

Here is our sample "Client Transition Process Flowchart':

IS NOW THE RIGHT TIME TO START EXPLORING YOUR OPTIONS?

The truth is that taking the time to get educated about the available opportunities is a smart business decision, regardless of whether you merely want - or are ready to make - a move. Advisors often wonder if there's a right time to begin the due diligence process. The reality is that it's crucial to stay aware and informed about the opportunities around you - especially in an environment that has evolved rapidly over the last several years.

Above all else: Prepare your mindset. Every business is unique, and despite thorough planning and good intentions, some situations are unpredictable. You might encounter a few surprises, such as clients who don't immediately follow you, but you'll likely be pleasantly surprised by others who do. Be aware of any retention tactics your former firm might employ; while they're typically ineffective, it's wise to be prepared with an appropriate response. Remember, the goal isn't a flawless transition. Instead, aim for having a solid support system in place to handle any challenges quickly and effectively, minimizing stress along the way.

You've already identified an opportunity that is "better enough" to justify a move, so keep in mind that the transition doesn't end when you walk into your new office. Moving is a process that may take several months, and it may involve some discomfort. However, if you take these additional preparatory steps, the only regret you'll have when looking back at those early days with your new firm is that you didn't make the move sooner.

Transition to a new firm with the Financial Advisor Flight Plan: DOWNLOAD OUR COMPLETE GUIDEBOOK