The Ultimate Financial Advisor Tech Stack

Learn what technology advisors are using in 2025

We find that the average financial advisor spends a staggering 41% of their week buried in administrative tasks. But interestingly enough, we also found that the right tech stack drops that down to just 15%.

The technology you choose shouldn't just be about shaving a few hours off your weekly to-do list - that's the wrong way to think about it. The real question is: how can you scale your business while spending less time working in it? You want technology that acts like a co-pilot, helping you grow your practice, automate the repetitive stuff, and still keep the personal touch your clients value most.

We've spent 25 years coaching independent advisors and registered investment advisers (RIAs) at Pareto Systems, and in that time, we've watched technology evolve from clunky desktop software to cloud-based ecosystems. Many of these solutions are specifically designed for independent financial advisors, helping them enhance client service, streamline operations, and maintain a competitive edge. We've distilled everything we've learned into a comprehensive blueprint for building your financial advisor tech stack in 2025. Inside, you'll see the exact tech stack architecture top independent advisors and RIAs are using right now to manage more clients, deliver a better experience, and still have a life outside the office.

Table of Contents

- What Is a Financial Advisor Tech Stack?

- Why Your Tech Stack Determines Your Growth Ceiling

- The 10 Core Tools of a Modern Advisor's Tech Stack

- Client Relationship Management (CRM): The Central Nervous System

- Financial Planning Software

- Portfolio Management & Reporting

- Risk Profiling & Portfolio Analytics

- Tax Planning & Optimization

- Document Management & E-Signature

- Client Communication & Marketing

- Compliance & Cybersecurity

- Business Intelligence & Practice Analytics

- Billing & Fee Management

- Tech Stack by Practice Stage

- Common Pitfalls and How to Avoid Them

- Frequently Asked Questions

What is a Financial Advisor Tech Stack?

A financial advisor tech stack is the integrated collection of software, platforms, and processes that power your advisory practice. Think of it as the digital infrastructure behind every client interaction, document, plan, and trade. It includes CRM systems, financial planning software, portfolio management tools, document management, marketing automation, compliance solutions, and business intelligence. Together, these tools allow independent financial advisors and RIAs to manage relationships, deliver advice, meet regulatory requirements, and scale the business without sacrificing service quality.

The 10 Core Tools Every Advisor Needs in Their Tech Stack

At its foundation, a comprehensive tech stack for financial advisors includes a range of essential tools. Below are the key components:

1. CRM (Client Relationship Management) - The command center for client data, workflows, and service delivery

2. Financial Planning Software - Tools for retirement planning, cash flow analysis, and goal-based planning

3. Portfolio Management Systems - Performance reporting, rebalancing, and investment analysis

4. Risk Profiling & Portfolio Analytics - Behavioral assessments, stress testing, and portfolio risk monitoring

5. Tax Planning & Optimization - Tax return analysis, strategy modeling, and tax-aware portfolio management

6. Document Management - Secure storage, e-signatures, and client vault capabilities

7. Client Communication Platforms - Email automation, scheduling, and client portals

8. Compliance Technology - Archiving, regulatory reporting, and audit trails

9. Business Analytics - Practice metrics, revenue tracking, and operational insights

10. Billing & Fee Management - Automated fee calculations, flexible pricing models, and transparent client billing

Why Your Tech Stack Determines Your Growth Ceiling

The tech you choose today sets the upper limit on how many clients you can serve tomorrow.

Here's the math:

A disconnected tech stack quietly steals about 12 hours every single week - time lost to re-entering client data, slogging through manual workflows, and hopping between systems. That adds up to 600 hours a year - the equivalent of 15 full work weeks gone.

Meanwhile, from our analysis, advisors with a well-integrated stack handle about 40% more clients without adding staff. They're not working harder - their technology is. Selecting the right tools helps streamline operations and supports every aspect of the advisor's business, from financial planning to client relationship management.

When you're losing 12 hours a week to friction with your tech, you're serving fewer clients, bringing in less revenue, and ironically leaving yourself with less budget to fix the very problem holding you back. From what we've seen, this traps most solo advisors at a hard ceiling of around 100 clients.

But with the right stack? Everything changes. Having the right tools gives your firm a competitive edge in the industry. Your team gains total clarity - everyone knows what needs doing, when it's due, and how to execute. Your assistant preps documents, your paraplanner builds plans, you run meetings - all orchestrated systematically with nothing falling through cracks.

Oh, and by the way, the hidden costs of poor technology choices run way deeper than what you can see at the surface level.

Client attrition increases when onboarding is clunky or service is inconsistent

Compliance risk multiplies with manual documentation and scattered records

Team burnout accelerates when talented professionals spend half their time on busywork

Growth stagnates because you're too busy keeping the lights on to chase new opportunities

The good news? With proper architecture, solo advisors and small teams comfortably manage 150-300 clients while actually improving service quality. The key is choosing technology that amplifies your strengths rather than forcing you to work around its limitations.

The 10 Core Tools of a Modern Advisor's Tech Stack

1. Client Relationship Management (CRM) - Your Practice's Central Nervous System

Your CRM (customer relationship management CRM) is the command center of your practice"every task, client interaction, and workflow should flow through it. Customer relationship management is essential for centralizing client information, automating workflows, and integrating with other financial tools to improve client service and operational efficiency. CRM systems support client management by streamlining client relationship activities, storing and organizing client information, and helping you build and strengthen client relationships. Task management is also a key feature of modern CRM systems, allowing you to automate and track tasks for greater efficiency. The right CRM does more than store contacts; it systematizes your client experience, automates service models, and ensures no commitment falls through the cracks. From tracking communication history to managing compliance-ready records, your CRM keeps your practice running smoothly.

In 2025, the difference between a practice that plateaus at 100 clients and one that scales past 300 often comes down to CRM. There is a wide variety of CRM tools available for financial advisors, each offering different features for client management, task management, and integration with financial planning software. Modern options like Toolkit CRM, Redtail, and Wealthbox vary in focus"some are pipeline-driven while others, like Toolkit, are built specifically for relationship-based advisors. Choosing the right one is critical.

Best CRM for Financial Advisors in 2025

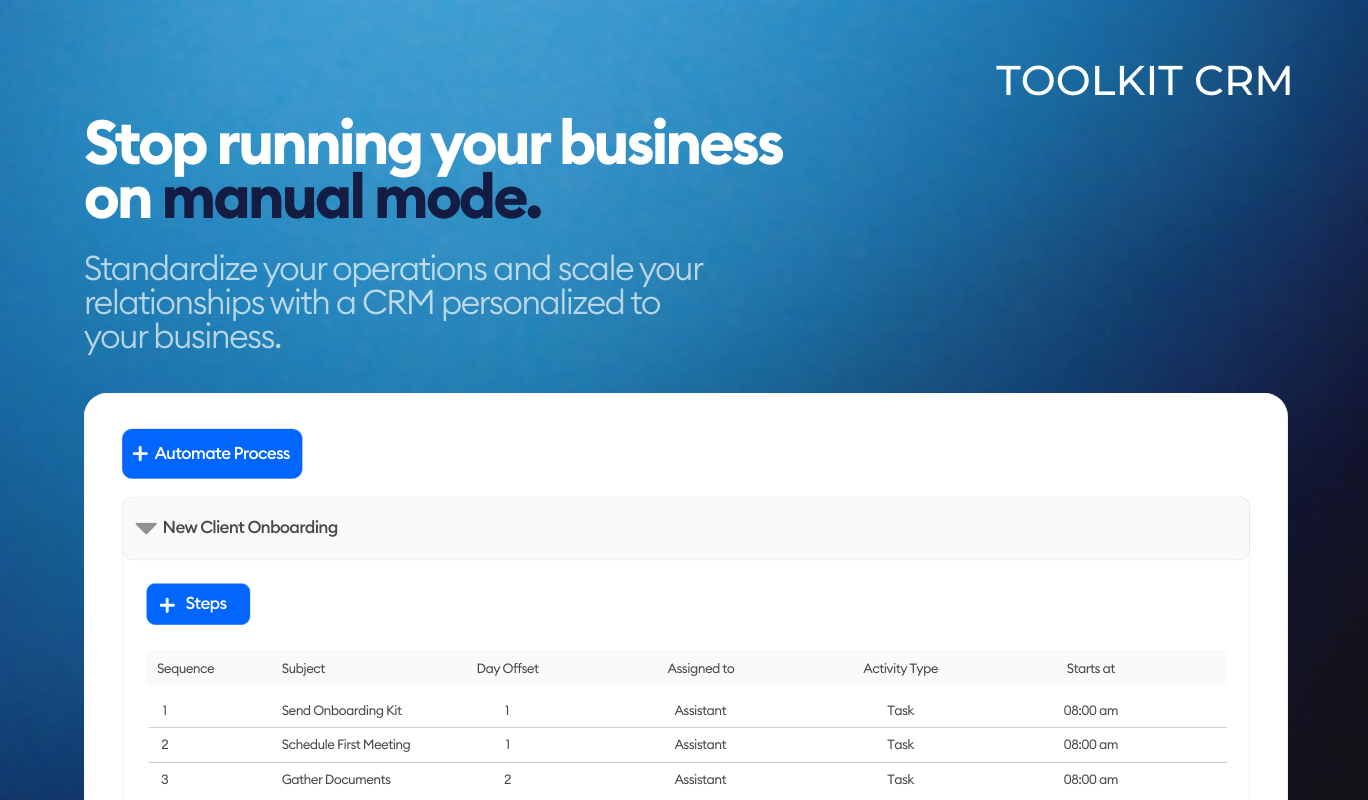

TOOLKIT CRM

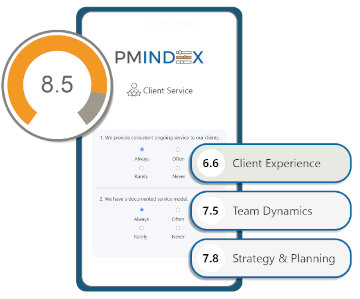

TOOLKIT stands apart because it's built specifically for relationship-driven advisors, and it's not a retrofitted sales software. While other CRMs focus on pipeline management and deal velocity, TOOLKIT focuses on client classification, service delivery, and relationship depth. The platform's Client Experience Builder lets you define exactly what each client tier receives and automates the delivery, which enhances client engagement and helps deliver exceptional client experiences.

Visit: TOOLKIT CRM

Redtail

Redtail dominates the market share, especially among broker-dealers, with approximately 26% of advisors using it (a notable decline from 46% in 2024). It offers solid integration capabilities and compliance features. However, it's essentially sales software adapted for advisors. The interface feels dated, workflows are rigid, and it treats every client interaction like a sales opportunity rather than a service touchpoint. User satisfaction has been declining (7.1/10 in recent surveys), with advisors citing the clunky interface and pipeline-focused architecture as pain points.

Visit: Redtail CRM

Wealthbox

has captured younger advisors with its modern interface and social-media-style activity feed. It integrates with over 150 custodial platforms and world tech applications - This is both its strongest and its weakest point, since the trade-off is ease of use. The ability to segment clients is nonexistent, and it lacks the depth needed for sophisticated practice management. It works well for the kind of team that requires complex integrated systems.

Visit: Wealthbox CRM

TLDR;

The critical differentiator: Redtail and Wealthbox are built for advisors who think in terms of pipelines and deals. TOOLKIT is built for advisors who think in terms of relationships and service. If your practice is about acquiring clients and moving them through a sales process, Redtail or Wealthbox might work. If your practice is about delivering differentiated service at scale while maintaining personal relationships, only TOOLKIT has the architecture to support that.

We've been in the consulting business for 25 years and have worked with some of the best teams in the world. And the one thing that we can tell you is that the difference between a practice that plateaus at 100 clients and one that smoothly scales to 300 is in the level of systems. And your CRM is the system that makes all other systems possible.

This is why your CRM choice is the most important decision you'll make.

2. Financial Planning Software - Turn Data Into Advice

Financial planning software transforms raw numbers into actionable strategies. This is where you demonstrate value beyond investment management.

Core capabilities needed:

Goals-based planning that connects client dreams to financial reality. Financial planning tools help clients clarify and track their financial goals, making it easier to visualize progress and stay engaged. Your software should model scenarios, stress-test assumptions, and show clients multiple paths to their objectives. Monte Carlo simulations, cash flow projections, and "what-if" analyses aren't fancy features - they're table stakes.

The client portal has become non-negotiable. Clients expect 24/7 access to their plan, progress tracking, and the ability to model changes themselves. The best planning software makes clients active participants in their financial journey, not passive recipients of annual reports.

Category Leaders:

eMoney Advisor

eMoney offers the most comprehensive planning capabilities, with sophisticated cash flow modeling and extensive customization options. The client portal (emX) is arguably the best in the industry. The downside: complexity and cost. Full implementation can take months, and the learning curve is steep.

Visit: eMoney Advisor

MoneyGuidePro

MoneyGuidePro takes a goal-based approach that resonates with clients. The Play Zone feature lets clients adjust variables and see impacts in real-time. It's more accessible than eMoney but less detailed in cash flow analysis. Best for practices focused on retirement planning rather than complex estate or tax strategies.

Visit: MoneyGuidePro

RightCapital

RightCapital has gained traction with its balance of sophistication and usability. The tax planning module is particularly strong, showing multi-year tax projections and Roth conversion opportunities. The interface is modern and intuitive. It's becoming the choice for RIAs who want eMoney's power without the complexity.

Visit: RightCapital

Integration with CRM: Financial planning tools are a core part of your technology stack, and robust integrations between these tools and other systems like CRM and portfolio management platforms while not essential, can give you a more sophisticated view of your client in one place. Client data should flow seamlessly between systems. When you update a client's risk tolerance in your CRM, it should reflect in their financial plan. When planning software identifies an insurance gap, it should create a task in your CRM.

3. Portfolio Management & Reporting

Clients hire you to manage investments, but they judge you on how well you communicate performance. Portfolio management software is essential for efficiently managing client portfolios, handling both the technical (trading and rebalancing, execute trades) and communication (performance reports, client statements) aspects.

Performance reporting that clients actually understand means moving beyond time-weighted returns and Sharpe ratios. Clients want to know: Am I on track? How much have I made? What did I pay in fees? Your reporting should answer these questions clearly, not bury them in financial jargon. Portfolio accounting is a critical function of these platforms, automating performance reporting, reconciliation, and ensuring accurate client reporting.

Platform Comparison:

Orion

Orion has become the industry standard for RIAs, offering robust reporting, rebalancing, and a solid client portal. The Eclipse trading platform streamlines portfolio management. The downside is cost and complexity - smaller firms might find it overwhelming.

Visit: Orion

Black Diamond (now part of SS&C)

Black Diamond excels at performance reporting and offers exceptional rebalancing capabilities. The interface is cleaner than Orion's, and the reporting is more customizable. It's particularly strong for firms doing complex alternative investments.

Visit: Black Diamond

Tamarac (Envestnet)

Tamarac provides an all-in-one solution including CRM, reporting, and rebalancing. The integration is its strength - everything works together seamlessly. However, you're locked into their ecosystem, and individual components aren't best-in-class.

The key decision: Do you want best-of-breed tools that require integration, or an all-in-one platform that handles everything adequately? Most growing RIAs choose best-of-breed initially, then consolidate as operational complexity increases.

Visit: Tamarac

4. Risk Profiling and Portfolio Analytics

Risk profiling reveals how clients actually behave when markets drop 20%, not what they claim in a conference room. Modern tools translate psychological money relationships into portfolios clients can stick with through volatility. These insights are crucial for developing personalized investment strategies that align with each client's unique risk tolerance and financial goals.

Beyond the Basic Questionnaire - Traditional "rate your risk 1-10" forms fail because they ask hypothetical questions during calm markets. Today's behavioral assessment tools show clients actual dollar losses and historical scenarios. Instead of "How would you feel about volatility?", they see "Your $500,000 could drop to $400,000, like March 2020." This reality check prevents aggressive bulls from becoming conservative bears at the worst possible moment.

Platform Leaders:

Riskalyze

Riskalyze dominates with its Risk Number system that scores portfolios 1-99. The 95% probability range shows clients exactly what normal volatility looks like in dollars. Stress testing and scenario modeling help prevent surprises. The downside: heavy focus on short-term volatility might make conservative clients too conservative.

Visit: Riskalyze

FinaMetrica

FinaMetrica brings psychometric science to risk assessment with 25-question evaluations validated across millions of investors. It captures risk tolerance (psychological) separately from risk capacity (financial ability), revealing mismatches that cause problems. Best for advisors wanting deep behavioral insights.

Visit: FinaMetrica

Orion Risk Intelligence

Orion Risk Intelligence combines risk profiling with macro scenario testing. Show clients how their portfolio performs under specific events - rising rates, recession, inflation spike. The correlation analysis reveals hidden risks in seemingly diversified portfolios. Particularly powerful for stress-testing during client reviews.

The implementation key: Connect risk profiles to your CRM and rebalancing triggers. When portfolios drift outside client comfort zones, you know before they panic. Use quarterly risk reviews with visual heat maps and scenario analyses to keep clients anchored to their long-term plan, not short-term headlines.

Visit: Orion Risk Intelligence

5. Tax Planning and Optimization

Tax planning software transforms overlooked deductions and timing opportunities into thousands of dollars of client value annually. These tools identify tax alpha that pays for your entire advisory fee - and then some.

Finding Hidden Tax Opportunities means scanning actual returns, not guessing. Upload last year's 1040 and within minutes see missed deductions, suboptimal asset location, and specific strategies with dollar values attached. Modern platforms project multi-year scenarios showing how decisions today impact taxes tomorrow.

Category Leaders:

Holistiplan

Holistiplan reads tax returns instantly, identifies 150+ planning strategies, and generates client-ready reports showing exact savings. The scenario modeling for Roth conversions and tax bracket management is exceptional. Integrates with most planning software. Limitation: focuses on individual strategies rather than coordinated household optimization.

Visit: Holistiplan

FP Alpha

FP Alpha goes deeper with estate and insurance analysis alongside tax planning. The platform quantifies complex strategies like qualified charitable distributions and donor-advised funds. Particularly strong for showing multi-year tax projections. Best for comprehensive planners doing sophisticated tax work.

Visit: FP Alpha

SEI LifeYield

LifeYield coordinates tax-smart trading across entire households. The platform handles asset location, tax-loss harvesting, and rebalancing while considering wash sales and tax budgets. Shows exactly how much tax alpha you're generating. Ideal for firms managing taxable wealth at scale.

The client communication advantage: Instead of vague "tax-efficient" promises, show exact dollars saved. "We identified $12,000 in tax savings this year through strategic gain harvesting and Roth conversions" beats "we manage taxes carefully" every time. These tools make your value tangible and fee conversations easy.

Visit: LifeYield

6. Document Management & E-Signature

The average client relationship generates hundreds of documents over its lifetime. Without proper document management, you're drowning in PDFs, searching through emails, and praying you can find that document the auditor just requested.

Compliance-ready document storage isn't optional - it's required. You need version control, audit trails, and secure access controls. The SEC doesn't care that the document is "somewhere in your email" - you need to produce it on demand.

Client vault functionality has evolved from nice-to-have to expected. Clients want one secure place to access statements, tax documents, estate plans, and insurance policies. Secure document sharing is now a key feature, allowing clients to upload and access documents safely, with real-time updates and enhanced communication. The best vaults integrate with planning software, so clients see documents in context with their financial plan.

Solutions Stack:

DocuSign + ShareFile combo

DocuSign handles signatures efficiently, while ShareFile provides secure storage and client portal capabilities. Dropbox Business is another secure, cloud-based document storage and sharing solution, offering advanced security features suitable for financial advisors who require compliance and confidentiality. The two-tool approach works but requires management.

Visit: Docusign

PreciseFP

Precise FP revolutionizes client onboarding by replacing PDFs with smart forms. Clients answer questions online, data flows directly into your CRM and planning software, and documents are generated automatically. It's not just faster - it's fundamentally better client experience.

Many advisors are moving toward integrated CRM document management. If your CRM includes robust document storage, why add another system? TOOLKIT CRM, for instance, includes document management within the client record - everything in one place, with proper compliance controls.

Visit: Precise FP

7. Client Communication & Marketing

Communication is where relationships are built or broken. In one study, 88% of clients said their advisor's communication style and frequency directly impacts their decision to stay or leave. Virtual meetings and virtual conferencing have become essential for seamless client interactions, enabling advisors to connect efficiently regardless of location.

Email automation that doesn't feel automated requires segmentation and personalization. Mass-blast newsletters get 12% open rates. Segmented, relevant content gets 35%+. Your communication platform should integrate with your CRM to trigger based on client events, not arbitrary schedules. Meeting client expectations for digital engagement is crucial to building trust and loyalty.

Modern Stack Components:

Brevo

Brevo is a high quality email marketing software platforms that handle newsletter basics well. It has a free plan and offer templates that can be easily redesigned for financial services. The key is segmentation - sending tax planning content to business owners, retirement content to pre-retirees, and education funding to young families.

Visit: Brevo

LOOM

Video messaging has moved from novel to normal. Tools like Loom let you record quick, personal videos. A two-minute video explaining a portfolio change is more effective than a two-page email. Clients appreciate the personal touch, and videos build deeper connections than text.

Visit: Loom

Calendly integrated with your CRM

Calendly eliminates the scheduling back-and-forth by allowing clients to book directly on your calendar. The meeting appears in your CRM with prep notes, and follow-up tasks are created automatically. This reduces scheduling conflicts and saves hours weekly, improving client experience. If you don't want to pay an extra cost for Calendly, you can use TOOLKIT CRM's scheduler at no extra cost.

Visit: Calendly

Visit: Scheduler (Free Alternative)

Communication platforms that offer secure messaging further enhance client trust by ensuring confidential information is shared safely. These tools support your marketing efforts, streamline lead generation, and help attract new clients by providing a seamless and professional experience.

Compliance considerations: Every client communication needs archiving. Email, text, social media - if it's about business, it needs recording. This isn't just about following rules; it's about protecting yourself. When a client claims you promised something you didn't, your archived communications are your defense.

8. Compliance & Cybersecurity

Compliance technology isn't sexy, but violations can very well end your career. One missed disclosure, one lost client document, one data breach - any could trigger regulatory action that could destroy your reputation.

Archiving requirements are non-negotiable. Every business communication needs capture and storage. This includes email (obvious), text messages (often missed), social media (if you use it for business), and even websites (yes, the SEC wants to see what your site said three years ago).

Compliance Tech Stack:

Smarsh

Smarsh leads in communication archiving. They capture everything, store it securely, and make it searchable for audits. The cost seems high until you face your first audit - then it feels like a bargain.

Visit: Smarsh

MyRepChat

MyRepChat is a communication and compliance platform designed specifically for financial advisors, combining secure messaging with archiving and compliance monitoring. It enables advisors to communicate with clients via SMS text, voice, and video while ensuring all interactions are automatically archived and compliant with industry regulations.

Visit: MyRepChat

RIA in a Box

RIA in a Box provide compliance management platforms. They track regulatory requirements, manage attestations, and provide templates for policies and procedures. These platforms also help identify areas of regulatory or security risk, allowing firms to proactively address potential weaknesses. Think of them as compliance consultants in software form.

Visit: RIA IN A BOX

Password managers and 2FA

These aren't optional anymore. Every account needs a unique, complex password. Every critical system needs two-factor authentication. LastPass, 1Password, or Bitwarden for passwords. Authenticator apps (not SMS) for 2FA.

How your CRM should support compliance: Your CRM should automatically log all client interactions, maintain audit trails for all changes, and flag compliance issues before they become problems. When regulators ask why you recommended a particular investment, your CRM should have the documentation ready. TOOLKIT CRM builds compliance into workflows - recommendation rationales are required fields, meeting notes are timestamped and unchangeable once finalized, and audit reports are one-click generated.

9. Business Intelligence & Practice Analytics

Most advisors fly blind, making decisions on gut feel rather than data. Business intelligence tools illuminate what's actually happening in your practice.

KPIs that actually matter:

Revenue per client (not just AUM)

Client acquisition cost by channel

Service hours per client tier

Client lifetime value

Referral generation rate

Task completion times

Analytics Layer Options:

CRM-native reporting

The CRM should be your starting point. If your CRM can't tell you which clients are most profitable, which services take the most time, and where referrals come from, you need a better CRM.

Power BI or Tableau

These tools can combine data from multiple sources - CRM, portfolio management, accounting - to provide holistic practice insights. The learning curve is steep, but the insights are powerful.

10. Billing and Fee Management

Billing platforms do more than calculate fees - they enable flexible pricing models, ensure accurate collections, and provide the transparency clients demand. Manual billing kills profitability and client trust simultaneously.

Modern Fee Flexibility goes beyond basic AUM. Today's clients expect options: flat fees, subscriptions, project pricing, or hybrid models. The right billing platform handles tiered schedules, household aggregation, performance adjustments, and family discounts automatically. No more spreadsheet nightmares or calculation errors that erode trust.

Platform Comparison:

Advyzon

Advyzon combines billing with reporting and CRM in one platform. Handles complex fee structures including retainers, hourly billing, and AUM seamlessly. The automated invoice generation and payment processing save hours monthly. Downside: you're buying into their entire ecosystem.

Visit: Advyzon

BillFin

BillFin specializes in fee management with exceptional flexibility. Create unlimited fee schedules, handle split billing between advisors, and automate complex calculations like excluding cash or alternatives. The audit trail satisfies compliance requirements perfectly. Best for firms with sophisticated billing needs.

Visit: BillFin

SmartRIA

SmartRIA focuses on automation and accuracy. Direct integration with custodians for daily balance calculations, automatic proration for mid-period changes, and fee visualization tools for clients. The performance reporting shows fees' impact clearly. Ideal for straightforward AUM billing at scale.

The transparency advantage: Modern billing platforms provide client portals showing exactly what they pay and why. Some even benchmark your fees against industry averages, turning potential objections into value demonstrations. When clients see detailed fee calculations and understand the value exchange, retention improves and referrals increase.

Visit: Smartria

Tech Stack by Practice Stage

Solo Advisor ($0-50M AUM)

A solo practitioner needs a minimum viable stack that delivers efficiency without breaking the bank. Aim to keep monthly costs under US$500 while preserving flexibility to upgrade later.

| Tool Category | Recommended Choice | Notes |

|---|---|---|

| CRM | TOOLKIT CRM | Designed for relationship-driven advisors, offering deep client experience automation and task management. |

| Financial Planning Software | RightCapital | Balances powerful features with usability; includes tax projections and goal-based planning tools. |

| Portfolio Management | Custodian-provided tools | Start with free basic trading and performance reporting; upgrade as complexity grows. |

| Document Management & E-Signature | Integrated CRM storage | Use the CRM's built-in document management for secure storage and compliance; add ShareFile if client vault needed. |

| Client Communication & Scheduling | Brevo + Scheduler | Use Brevo to mass email your clients about updates etc. Start with a free plan to keep costs down. Use the free built-in scheduler in TOOLKIT CRM to allow clients to book a time with you without the back-and-forth. |

| Virtual Conferencing & Screen Sharing | Microsoft Teams | Provides secure virtual meetings and screen sharing to enhance client interactions. |

| AI Tools (Optional) | Zocks Notetaker | An AI note taker saves you so much time by taking notes, formatting it, and updating the CRM record without manually having to do anything. |

CRM: TOOLKIT CRM (relationship management, not pipeline management)

Planning: RightCapital (powerful but accessible)

Portfolio: Your custodian's free tools initially

Documents: Integrated CRM storage or ShareFile

Communication: Brevo + Scheduler (built into TOOLKIT CRM)

What to prioritize: CRM and planning software are non-negotiable. For solo advisors, must-have tools include specialized financial advisor tools that streamline daily operations and ensure compliance. Increasingly, AI tools are becoming essential for efficiency, automating tasks like document analysis and client engagement. Everything else can start simple and upgrade as you grow.

What to defer: Sophisticated portfolio management, advanced analytics, and marketing automation can wait until you have enough clients to justify the cost.

Growing Practice ($50-250M AUM)

As you add staff and clients, complexity increases. At this stage, consider upgrading the following:

Portfolio management - Around $75 M AUM, the efficiencies of dedicated platforms like Orion or Black Diamond outweigh their cost. Automated rebalancing and comprehensive reporting save dozens of hours monthly.

Communication archiving - Before hitting $100 M AUM, invest in compliance archiving (Smarsh/Global Relay) and a compliance management platform (RIA in a Box/ComplySci). Regulatory scrutiny intensifies as you grow.

Workflow and team features - When you hire an assistant or paraplanner, your CRM should support user roles, task assignments, team dashboards and load balancing.

Advanced planning - Upgrade to eMoney or MoneyGuidePro if your clients' planning needs become complex. Consider RightCapital's tax module for multi"year tax planning.

Evaluate ROI on each upgrade. A $3,000/month portfolio platform may seem expensive until you realize it saves 20 hours per month on reporting and rebalancing - worth far more at your billable rate. Investing in the right technology not only streamlines operations but also helps maintain high client satisfaction as your practice grows.

Enterprise RIA ($250M+ AUM)

At scale, your tech stack becomes a competitive advantage. Look for enterprise features such as:

Multi"custodian support - Manage accounts across multiple custodians without duplicating workflows.

Custom reporting and white"labeling - Tailor reports to your brand and client preferences.

APIs and proprietary integrations - Build bespoke solutions that integrate with internal systems (e.g., accounting, marketing automation, client portals). Evaluate vendors' integration scores and developer resources.

Advanced compliance workflows - Manage complex supervision and surveillance requirements, multi"advisor teams and hierarchical permissions.

Data warehouses and analytics - Aggregate data into a centralized warehouse for advanced BI; leverage data scientists to identify trends.

Specialized planning and reporting tools are especially important for serving high net worth clients, as these clients require tailored solutions and heightened value at the enterprise level.

At this level, you're not just buying software - you're designing technology to differentiate your firm. Consider hiring or partnering with an internal technologist or consultant who understands both wealth management and systems architecture.

Common Pitfalls and How to Avoid Them

Even with the best intentions, advisors often stumble when building their tech stacks. Avoid these common mistakes:

Overbuying features - Don't fall for shiny objects. Start with essentials and upgrade as your practice demands. Buying an enterprise solution when you're managing $25 M AUM will only drain resources.

Vendor lock"in - All"in"one platforms are convenient, but you sacrifice flexibility. Before committing, ask whether data can be exported and whether you can replace individual components without disrupting operations.

Ignoring training and support - Implementation is where most firms fail. Budget time and money for onboarding, and choose vendors who offer hands"on support.

Poor data hygiene - Inconsistent data leads to bad decisions. Establish data entry standards, require mandatory fields and audit your database regularly.

Neglecting security - Small firms often assume they're too small to be hacked. Implement password managers, MFA, encryption and regular security training. A single breach can ruin your reputation.

Failing to review the stack annually - Technology evolves quickly. Review your stack at least once a year. Eliminate unused tools, renegotiate contracts, and adopt new solutions that offer meaningful improvements.

Frequently Asked Questions (FAQ)

What is a financial advisor tech stack?

A financial advisor tech stack is the integrated collection of software tools and platforms that financial professionals use to manage their advisory practice. It includes customer relationship management (CRM) systems, financial planning software, portfolio management systems, document management, compliance support, marketing automation, and business intelligence tools. Together, these tech tools streamline operations, enhance client engagement, and support regulatory compliance.

Why is having the right RIA tech stack important for financial advisors?

The right RIA tech stack determines your practice's growth ceiling by automating administrative tasks, improving client communication, and enabling efficient investment management. It helps financial advisors serve more clients without sacrificing service quality, reduces compliance risk, and prevents team burnout. A well-integrated tech stack provides a competitive edge in today's digital-first financial landscape.

What are the must-have tools in a modern financial advisor tech stack?

Key components include CRM systems for client management, financial planning software for personalized advice, portfolio management platforms for investment oversight, risk profiling and portfolio analytics, tax planning tools, document management with secure file storage and e-signatures, client communication platforms with email marketing and virtual conferencing capabilities, compliance and cybersecurity solutions, business intelligence for detailed analytics, and billing and fee management systems.

How do client portals improve the client experience?

Client portals allow clients to securely access their financial plans, investment reports, and documents anytime. They foster transparency and trust by providing real-time updates and interactive tools for clients to model their financial goals. Incorporating client portals in your tech stack enhances client engagement and satisfaction.

Can a financial advisor tech stack help with compliance?

Yes. Compliance support technology automates regulatory reporting, communication archiving, and audit trails. It ensures that all client interactions and documents are securely stored and easily retrievable, reducing compliance risk and simplifying regulatory oversight.

How does integration between software tools benefit my practice?

Integration allows seamless data flow between CRM, financial planning software, portfolio management, and other tools. This reduces manual data entry, minimizes errors, and improves efficiency. Integrated systems enable advisors to deliver a more personalized and timely client experience while streamlining internal workflows.

What role do AI tools play in a financial advisor tech stack?

AI tools assist with automating repetitive tasks such as document analysis, lead generation, and client engagement. They can also enhance marketing efforts through pre built campaigns and optimize scheduling and communication. Incorporating AI-powered tools helps advisors save time and focus on higher-value activities.

How should I choose the right tech stack for my practice stage?

For solo advisors or small practices, focus on essential tools like CRM, financial planning software, and basic portfolio management to keep costs manageable. Growing practices should consider adding advanced portfolio management, compliance archiving, and marketing automation. Enterprise RIAs benefit from multi-custodian support, custom reporting, and advanced analytics. Always prioritize scalability and robust integrations.

What are common pitfalls to avoid when building a tech stack?

Avoid overbuying features you don't need, vendor lock-in that limits flexibility, neglecting staff training, poor data hygiene, insufficient cybersecurity measures, and failing to review and update your tech stack regularly. A strategic approach ensures your technology investments deliver maximum value.

How can virtual conferencing and screen sharing tools enhance client communication?

Virtual conferencing and screen sharing enable face-to-face client meetings regardless of location, improving convenience and relationship building. Tools like Microsoft Teams facilitate seamless collaboration, secure messaging, and efficient document sharing, all of which contribute to an exceptional client experience.

How does marketing automation support financial advisors?

Marketing automation platforms help advisors manage email marketing campaigns, lead nurturing, and client communications with personalized content and pre built campaigns. Integrating these tools with your CRM ensures consistent outreach and helps grow your client base while maintaining strong client relationships.

What is the impact of detailed analytics and business intelligence in an advisory practice?

Detailed analytics provide insights into practice metrics such as client acquisition cost, revenue per client, referral rates, and task efficiency. Business intelligence tools help advisors make data-driven decisions to optimize operations, improve client satisfaction, and scale their practice effectively.