The Power of Client Advisory Councils

I've often emphasized the transformative impact of Client Advisory Councils. These councils are not just strategic tools, but platforms for profound engagement. They bring advisors and clients together to foster understanding, collaboration, and collective advancement.

What is a Client Advisory Council?

A Client Advisory Council is essentially a hosted meeting of a hand-picked group of ideal clients, brought together to provide honest feedback, impart wisdom, and engage in substantive discussions about the financial landscape and the financial advisor's services. It's a deliberate, structured, and meticulously orchestrated forum that leverages the collective intelligence and goals of clients to drive meaningful enhancements within an advisory practice.

Why Run a Client Advisory Council?

In an advisor's mission to deliver unparalleled services and innovative advice, the true driver of improvement lies in understanding our clients; their needs, concerns, and ambitions. Client Advisory Councils are pivotal tools to uncover those unmet needs and enable advisors to:

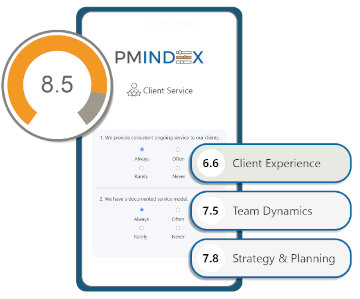

- Capture Genuine Feedback: In a domain awash with data and noise, authentic feedback is invaluable. These councils offer a rare platform for clients to voice their genuine thoughts and suggestions.

- Cultivate Client Loyalty: By involving clients in the evolution of an advisory practice, advisors demonstrate respect for their input, fostering loyalty and trust.

- Stay Proactive and Ahead: The financial advisory sector is dynamic. Insights from these councils enable advisors to anticipate shifts, refine strategies, and stay ahead of the curve.

How do I Build a Client Advisory Council?

- Selecting the Right Participants: The composition of the council is crucial. A blend of seasoned and newer ideal clients offers a comprehensive perspective, enriching discussions and insights.

- Developing a Structured Yet Adaptable Agenda: While a structured approach is essential, flexibility is key. It's crucial to allow the conversation to flow naturally, ensuring comprehensive coverage of all important topics. Your agenda should drive conversation but not dictate its content.

- Implementing Action and Feedback Loops: The greatest value lies in post-meeting analysis. It's critical to study the feedback, make an action plan, and communicate the steps that will be taken based on this invaluable input.

The insights from these councils are game-changing. I can recall instances where the feedback led to significant shifts in advisory service models, aligning them more closely with what clients truly seek " transparency, partnership, and a commitment beyond financial metrics. All of which makes the advisor more referable and clients likelier to advocate for them.

Client Advisory Councils are more than feedback mechanisms; they are catalysts for mutual growth and evolution. They help advisors to actively listen, intelligently adapt, and continuously evolve, ensuring that their practices don't just survive but flourish. It's a path of learning, growth, and success, where both advisors and clients thrive together.

For an in-depth exploration of this topic, tune in to Episode 53 of the Always On Podcast where fellow Pareto Coach Mike Cy and I delve into the nuances of 'How to Run a Client Advisory Council,' offering practical insights and real-world experiences to guide you through this transformative journey by clicking here: paretosys.co/AODM_ep53

Written by Duncan MacPherson, CEO of Pareto Systems and author of The Blue Square Method