Testimonials and Online Reviews Marketing Strategy

Waiting to Embrace Online Reviews. That's the Real Risk.

In a profession built on trust, few things are more powerful than the words of a satisfied client.

Until recently, financial advisors have been locked out of the most influential trust-building tool of the digital age: online reviews.

Thanks to the SEC's updated Marketing Rule, that door is finally open - and the firms that are walking through it are gaining a competitive edge.

This isn't just a fringe financial advisor marketing opportunity. It's a transformation that mirrors a shift we've seen before. Twenty years ago, having a website was considered a nice "enhancement". Today, it's a non-negotiable requirement.

Online reviews are following the same trajectory. The risk isn't in embracing them - it's in waiting too long to start.

Here are some questions we can help answer:

- What is the SEC rule that changed the game for financial advisors?

- What other industries already have online reviews?

- Why will early adopters win?

- What are the risks with compliance?

- How do you embrace online reviews and client testimonials with confidence?

What is the SEC Rule that changed the game for financial advisors?

In late 2022, the "new" SEC Marketing Rule went into effect, allowing advisors to use testimonials and endorsements in advertising, so long as they meet defined disclosure, oversight, and compliance standards.

It's a clear signal: the regulatory environment has caught up to the expectations of modern consumers.

Now, advisors can collect and display client testimonials - as long as they do it the right way (click the link above to download the details of the rule in PDF form).

What other industries already have online reviews?

Online reviews are now an essential part of how people make decisions:

- 93% of consumers say online reviews impact their buying decisions

- Podium, 2023 State of Reviews (source) - In sectors like healthcare, home services, and B2B software, reviews often drive more conversion than referrals - because they're scalable, persistent, and searchable.

- As search and AI tools like ChatGPT become embedded in daily decision-making, firms with strong online reputations will dominate the early results.

In short: the way consumers make decisions has changed. Financial advisors can either catch up - or be left out.

Why will financial advisors who are early adopters win?

Advisors and firms embracing online reviews and client testimonials today are positioning themselves to:

- Build instant credibility with both referrals and prospects

- Increase conversion rates across all channels

- Improve visibility in traditional search and AI-generated summaries

- Strengthen advisor morale by sharing real, positive client feedback

- Gain clarity on what clients actually value - in their own words

Social proof doesn't just validate your value - it helps articulate it more clearly to the next client. Just have a look at how Pareto Systems has embraced online reviews in financial services.

Listen to our recent podcast episode:

Or find your favorite Podcast Channel

What are the risks with compliance?

The biggest reason for hesitation we hear from financial advisors? Compliance.

What if a client says something problematic? What if the testimonial gets flagged by a regulator? What if the firm loses control?

Here's the truth; with the right structure, online reviews can be more controlled than traditional word-of-mouth. You just need:

- A closed-loop system for collecting reviews privately

- A chance to review and approve any feedback before it's published

- A well-written policy articulating the conditions under which you would NOT publish a review (offensive language, content that runs afoul of advertising regulations)

- The ability to manage and display testimonials in full alignment with SEC and FINRA guidance

Compliance isn't the obstacle - it's your design brief.

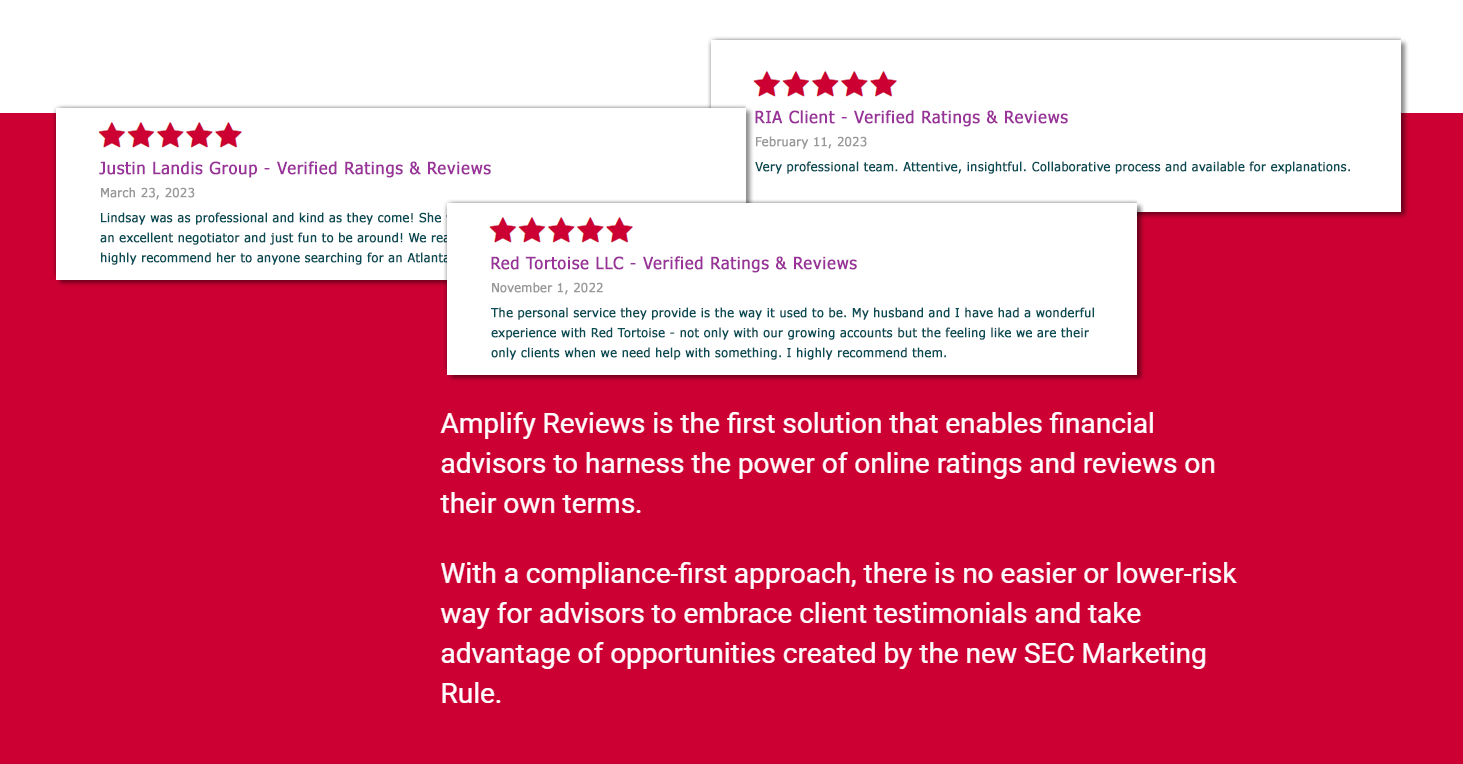

How do you embrace online reviews and client testimonials with confidence?

When you're ready to move forward, here's how to do it without exposing your firm to unnecessary risk:

- Use a compliance-first platform built for advisors - Skip generic tools that weren't built for regulated industries.

- Invite client feedback thoughtfully - There are several compliant approaches which avoid "cherry picking."

- Publish only if you're happy with what you collected - You can't just publish your three favorite testimonials, but you can review the totality of the feedback you've collected before you decide whether to publish it.

Aim for maximum transparency - Beyond the required disclosures, explain your reviews program on your website so prospects have a reason to trust their contents.

Firms that treat reviews like websites 20 years ago - optional, risky, or not worth the effort - will soon find themselves behind.

Firms that act now will stand out, build deeper trust, and capture more business from clients who are actively searching for credible, human proof of value.

The biggest risk isn't embracing online review, it's waiting to do it.

Special Offer for Pareto Community Members

As a member of the Pareto Systems community, you're eligible for an exclusive discount on the Amplify Reviews platform.

Learn more and claim your offer here

About the Author

Whit Lanier is the founder and CEO of Amplify Reviews, a platform purpose-built to help financial advisors collect, manage, and publish online reviews in a way that's fully compliant with SEC and FINRA guidelines. His previous company processed over 50 million reviews for some of the nation's largest healthcare systems. Today, he helps advisor firms turn client feedback into a scalable source of trust, referrals, and growth.