Every Business is Built to Be Sold

Every Business Is Built to Be Sold

The statement "every business is built to be sold" may sound counterintuitive, especially to business owners who have dedicated their lives to building and growing their enterprises. However, upon closer examination, this assertion reveals itself to be a valuable piece of advice for all entrepreneurs, including financial planners.

Planning Your Own Future Like You Plan for Clients

A financial planner's job is not just to advise clients on how to create a nest egg but also to be a lifelong planner in all respects. This means that financial planners must think about their own financial futures and plan accordingly. One aspect of this planning is considering the sale of their business as a viable option.

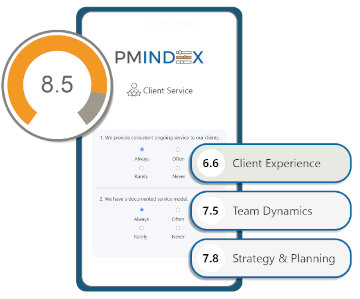

Building Enterprise Value Beyond EBITDA

Every investment of effort made in working on a business contributes to forced savings. Additionally, there is the force multiplier, where all the effort and investments culminate to drive enterprise value. While most businesses may think in terms of EBITDA and other fundamentals, there is so much more that goes beyond that.

Let the Market Speak

Financial professionals may develop intellectual property within their businesses that can significantly increase the outcome. However, it is essential to consider the full spectrum of options when thinking about selling the business.

While some financial advisors may rely on valuations done by FP Transitions or independent persons, these valuations may not give an accurate representation of the market value. Instead, taking the business to the market and seeing what offers come up is the best way to determine its true value.

The market always speaks, and it will tell you the exact value of your practice because someone will put an offer on the table. It may be worth more or less than what you initially thought, but the market will reveal the truth.

Your Business Is an Asset, Plan Accordingly

For financial advisors, this is even more critical because their business is one of the most valuable businesses, behind technology and other things, due to the cash flow it generates. This is why future pacing is essential and understanding the scope of the market.

In conclusion, the mantra "every business is built to be sold" is not about giving up on your business or losing your passion for it. It is about having a plan for the future, thinking about the full spectrum of options, and understanding the scope of the market. For financial planners, it is essential to think about their own financial futures, and this includes considering the sale of their business as a viable option.