Getting Out In-Front of Client Needs

Full Disclosure Leads to Full Empowerment

When we coach a financial advisor on how to improve his or her productivity, profitability and efficiency, we start a process to identify their untapped opportunities as well as any overlooked vulnerabilities. This enables us to quickly establish where the low hanging fruit is, as well as any issues that are undermining their ability to achieve a breakthrough.

Often, the most startling untapped opportunity stems from clarifying the distinction between a customer and a client. A Customer does some business with you but they also have needs fulfilled by one or more other service providers. A Client empowers you fully. You are their personal CFO. Every need they have, they empower you. And just as importantly, when a new need presents itself, the client instantly contacts you looking for a solution. A customer goes shopping.

But this goes beyond just the status of your existing clients’ needs. Money is constantly in motion and needs are continually evolving. It’s essential that you have a process to ensure that you are the go-to advisor when a new need emerges. This way you don’t have to go chasing the business. You attract it.

So the question to ask, as part of your own strategic analysis is, do you have any customers among your client base and what are the benefits of taking action to convert them? The next question is, how would your business change if you started all new relationships from the perspective of full empowerment?

The practical benefits are obvious. A business made up of fully empowering clients means that you can grow the amount of assets you’re managing without growing the number of relationships you manage. Plus, you don’t have rely strictly on a client acquisition strategy to convince new people to come on-board. Convincing people can be draining – like pumping up a leaky tire. When you work with the people who are already convinced, as new money in motion develops, they contact you to meet those needs.

All of which, brings me to a series of symbolic benefits too. Sure, a client that calls you for a college plan for a new grand-daughter isn’t going to impact your next paycheck very much. But the action speaks volumes. Clients are more loyal and they are better equipped to describe you persuasively to others. Clients tell their friends that “My financial advisor takes care of everything for me and does a stellar job.” That is advocacy in action. Customers say, “I have a couple of different people who handle my investments, insurance and other things.”

The key is to have a process that enables you to get in front of unmet needs so that the moment they appear, you are getting the phone call. Going forward, you need to re-frame your existing relationships so that they see the merit of this strategy and become trained – for lack of a better term – to anticipate contacting you immediately. And with new clients, you want to plant seeds early in the on-board process to future-pace how the relationship will look as it unfolds.

On-Boarding New Clients

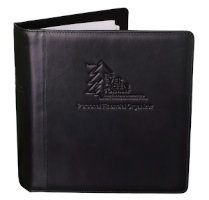

The key with a new relationship is to explain how you conduct yourself and the role you will play in the client’s life as your relationship progresses. The best way to do that is to present an impressive binder loaded with tabs and explain your service process to set expectations for how you will conduct yourself. A good starting point is to say your own variation of this:

“The financial planning process is very dynamic and there are many pieces to the puzzle. My job is to put those pieces into place as your life unfolds and your needs evolve.” Then present a document – we call it a Personal Financial Organizer (PFO) – which contains a listing of every single service you provide along with a Take Action box beside it. You then say, “This is a listing of everything I provide for my clients. Many of these solutions aren’t relevant to you and your family today but they may become relevant in the future. As part of our review process, we will use this tool to anticipate needs and strategize your personal plan to align with your goals to ensure everything is taken care of in a precise manner.”

Re-framing Existing Customers

In your next review meeting with clients and customers, simply present the PFO and say this:

“We take great pride in providing exceptional service to our clients and ensuring that we anticipate needs and provide solutions that complement your complete personal financial plan. But we never want to become complacent and we know that we can always raise the bar. So going forward this binder will become the centerpiece of our review process and become an important hub for the important documentation we send you.”

Then, as part of your agenda as you walk through the binder, introduce your document that outlines your various services, and outline a modified version of what we discussed above. You’ll be amazed at how many of your customers/clients will say to you, “I didn’t know you did all of that.”

The binder becomes a tangible symbol of the strength of your process. It locks relationships down, uncovers assets that are placed elsewhere, and ensures that it’s a knee jerk reaction that clients call you when money is in motion. It also makes it easy for clients to conceptualize your value and easy for them to describe you to friends and family members too.

Continued Success!

Contributed by Duncan MacPherson