Guide to Financial Advisor Coaching

How to Explore Coaching Benefits & Costs

Are you spinning your wheels trying to grow your business? Do you have growth, but want more time to spend with family and friends? Do you feel your clients deserve a better, more consistent experience? If so, you're not alone.

Advisors seeking an edge have increasingly turned to coaching as a strategy - but is it the right choice for you?

This Financial Advisor Coaching Guide explores that question. It covers core benefits, potential drawbacks, and how to identify the right coach, so that you can make an informed decision.

Here are some questions we will answer:

- What is Financial Advisor Coaching?

- Why would Financial Advisors Need Coaching?

- What Can A Good Financial Advisor Coach Do for Me?

- Do All Financial Advisors Need Coaching?

- Is Coaching Worth the Cost?

- What questions should I ask when hiring a coach?

- What should I Watch Out For When Hiring a Coach?

- Is Coaching Right for Me?

What Is Financial Advisor Coaching?

The first step toward improvement is knowing the limitations of your personal knowledge and, importantly, measuring your motivation to improve. This applies universally, whether you seek to optimize your physical fitness, improve sleep patterns, or refine your golf game.

Coaching is working with a third party - a second set of eyes - who can take an objective look at your business and provide you with clarity. They can make recommendations on gaps in growth and client acquisition, refining systems and process, creating a better more consistent client experience, marketing and prospecting, and implementing business best practices.

Duncan MacPherson a thought-leader and coach in the financial services industry, says "coaching is for guidance, accountability and implementation; both for what you know, and for what you don't."

The Winning Edge: Why would Financial Advisors Need Coaching?

In any competitive sport, the difference between success and failure can be razor-thin. Financial advisors are no different. They constantly strive to outperform opponents and deliver exceptional value to their clients. This is where coaching comes in. It can be the difference that helps advisors achieve the "winning edge," that small yet crucial advantage that leads to outsized results.

In professional sports, the best athletes rely on coaches to stay at the top of their game. Take Michael Jordan. Despite his unmatched skills and dominance, Jordan never stopped working with shooting coaches like Johnny Bach. These coaches helped him refine his technique, identify areas for improvement, and ultimately maintain his legendary accuracy.

Financial advisor coaching works in a similar way. While advisors may possess strong core skills and experience, a coach can provide invaluable support in areas like:

- Mastering the fundamentals

- Developing a system

- Staying mentally sharp

- Building a thriving Business and team

Just like Michael Jordan with his shooting coach, advisors can leverage coaching to achieve the winning edge.

What Can A Coach Do for Me?

In 2019, the International Coaching Federation (ICF) completed a study, and found that coaching yields an average return on investment of seven times the program cost. That is an astounding ROI! It should be appealing to you as a financial advisor, someone who fully understands the value of that metric.

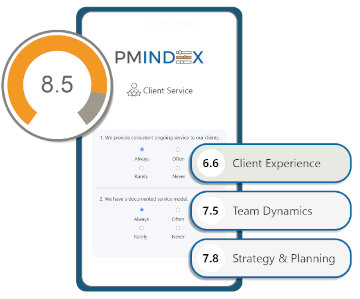

Advisors are busy. It can be easy to lose sight of the big picture. A good coach can help you achieve the clarity you crave. While a coach won't magically solve all your problems, they can help you by:

- Being a "partner in your business - They should understand you, your team and how your business operates.

- Holding you accountable - Sticking to a plan can be challenging. A good coach will regularly check in on your progress and keep you motivated.

- Implementing best practices - They will introduce them and help you take action.

- Providing a fresh perspective: Sometimes, you're so close to your business that you can't see the forest for the trees.

- Building your confidence - Overcome your fears, and become a better communicator.

- Developing business acumen - Run your business like a business.

- Avoiding costly mistakes - An experienced coach has had many interactions with other advisors, and have learned what works and what won't.

- Providing support and mentorship - Sometimes this business can be isolating for advisors.

Do All Financial Advisors Need Coaching?

The answer is a qualified "yes." Financial advisors can always benefit from a coach's expertise, but this doesn't mean all financial advisors are coachable.

Here's a breakdown of who might benefit the most. What category of financial advisor do you fall within?

Category #1: New Financial Advisors

The early stages of an advisor's career are full of potential, but also come with unique challenges. For many advisors that have been in the business for 15-20 years, and have never done coaching, they look back and wish they had from the start. New advisors need to build a strong foundation, develop baseline skills, and focus heavily on prospecting and client acquisition. Confidence building is critical to launching a successful career.

The advantage new advisors have is they're typically more receptive to guidance, compared to established financial advisors who may have ingrained habits that are harder to "un-learn."

Category #2: Plateaued Financial Advisors

Many advisors reach a point where growth stagnates and they find themselves stuck or burnt out, unable to grow and/or have become inefficient at scale. A coach can identify the root cause behind the plateau. Often, the solution is simply adjusting a few things: Redefining goals, restarting motivation, refining the client experience, improving systems and process, and communicating in a more compelling way to clients.

The key is to remember that coaching is not about making dramatic wholesale changes to your business. It's about minor adjustments and improvements to what you are currently doing.

Category #3: Growth & Scale Oriented Financial Advisors

Seasoned advisors that are ambitious and constantly seeking improvement will likely seek the guidance from a coach. They view a coach as a means to their end. A partner that understands them and the vison they have for their business. They have a mission to become the best and provide more value than anyone else. They are actively seeking better ways to implement scalable growth models and streamline operations to achieve those outcomes.

Category #4: Exit or Succession Focused Financial Advisors

Financial advisors seeking to sell their business and implement a succession plan face unique challenges. How do you ensure that your clients are taken care of after you're gone, and how do you ensure your legacy remains intact?

A coach can help you increase the enterprise value of your business, ensuring that you fully monetize your life's work. A good coach will ensure a smooth transition for you, your clients and your successor. Seek out a coach that has experience and expertise in this area.

Is Coaching Worth the Cost?

When you're considering hiring a coach, it's an investment. Treat it as such. What is the cost? What is the benefit? How will this improve my business? How will this improve my client relationships? How will this improve my life?

Even a simple monthly coaching fee can mean hundreds of hours of time saved per year through efficiencies. Further, imagine attracting just a few new high-value clients. The additional revenue can easily outweigh the ongoing cost of coaching.

The decision to hire a coach depends on your situation. For a new advisor, the cost might be a hurdle, so seek out an option for online or on-demand coaching, which is typically more cost-effective. For established advisors, the risk-reward is more attractive. The more clients and revenue you have, the easier it is to justify the investment and unlock significant growth through coaching.

What are some common fee structures for coaching?

- Monthly Coaching Fee: This coaching option is essentially a subscription, where you are retaining the time of your coach. This is the most highly recommended option, as you pay for what you get, and it puts the accountability on the coach to continuously provide value to the relationship. This fee typically ranges from $500-$5,000 per month, depending on the complexity of your business, your team size, and the number of sessions each month.

- Pay-per-Coaching Program: This option provides you with a clear understanding of what you will be coached on, but you typically have to pay the entire cost of the program upfront, so there is normally no option for a refund if the experience didn't align with your expectations. A program can cost anywhere from $500 for a specific topic, or up to $40,000 for a full program.

What questions should I ask when hiring a coach?

Choosing the right business coach can significantly impact your success as a financial advisor. Here are some questions that you should consider asking:

Experience and Expertise:

- Do you specialize in coaching financial advisors?

- What are your credentials and certifications?

- Can you share past success stories of financial advisors you've coached?

Coaching Philosophy and Approach:

- What is your coaching philosophy?

- How will we structure our coaching sessions?

- What tools and resources do you offer?

Coaching Alignment and Fit:

- Can we schedule a complimentary consultation to discuss my specific needs and goals?

- What are your expectations for my commitment to the coaching process?

- Should my team of financial advisors, client associates and support staff participate in the coaching?

Additional Considerations for Coaching:

- What is your coaching fee? How is it determined?

- Do you have contracts?

- Do you have a cancellation policy?

- What happens if I don't like my coach? Can I switch coaches?

What should I Watch Out For When Hiring a Financial Advisor Coach?

There are many varieties of financial advisor coaches, not all of them great. Here are some things to beware of:

- They don't have a specific type of client they coach

- They have limited experience

- They bring you on as a client without determining fit or alignment

- They offer low fees, and thus probably deliver low value

- They want to focus on experience over results

- They offer inflexible coaching versus a customized approach

- They lack specialization

So, Is Coaching Right for Me?

A little self-reflection is a good idea. After reading this guide, do you feel a coach could potentially help you?

If the answer is "yes", the next question is: Are you coachable? Are you someone that can take constructive criticism or advice from a coach, or will it be a constant battle of egos trying to "win" in the end?

If the answer is "yes" again, then take the next step, explore your options and speak to a few coaching firms.

Download our Guide to Financial Advisor Coaching

Do you want to learn how to implement financial advisor marketing strategies, build a better business, or have a better work-life balance? Speak with a Pareto Systems expert to learn more about our Financial Advisor Coaching Programs.

Or learn more about our business coaching for financial advisors at paretosystems.com/coaching