Unlock Consistent Client Acquisition with a Gap Analysis

We can, if we so desire, refuse to cooperate with the blind forces that are propelling us. - Aldous Huxley

The gist of this article is very simple; a gap analysis can reveal where minor adjustments can be made in your business, and highlight that it’s usually minor adjustments that can lead to major improvements. Very few advisors I work with are way off track, or need dramatic wholesale changes to the way they conduct themselves. But the adjustments needed aren’t always obvious without a fresh set of eyes to identify them.

Case in point, in our on-going practice management coaching with financial advisors we often remind our clients of this simple fact: being a great financial advisor in and of itself is no guarantee for success in this business. We have seen time and time again where the most effective advisors with limitless growth and progress potential aren’t necessarily the most sophisticated asset managers. The common thread however is that they are the most effective at practice and relationship management.

History provides countless examples in many walks of life that demonstrate the need to possess strong business acumen along with core skills. One of my favorite examples is the rivalry between Nikola Tesla and Thomas Edison, two inventors who both made enormous contributions to society but also had two dramatically different outcomes in life. Edison’s company ended up becoming GE while Tesla sold his patents to Westinghouse and ended up dying alone, impoverished, and in debt. Many argue that Tesla was as good, or even a better inventor, than Edison but Edison’s business skills were far superior.

Clearly I will never trivialize the importance of being a skilled asset and risk manager. But it is a given that you are effective there. My point is that there is little correlation between how effective you are as a financial advisor and how successful you will ultimately be in terms of unlocking your full potential. The days of building the better mouse trap and the world beating path to your door are long gone. Sure ongoing professional development to sharpen your asset management skills is essential, but do you invest the same amount of time sharpening your practice and relationship management processes too? They are of equal importance at the very least.

The Gap Analysis

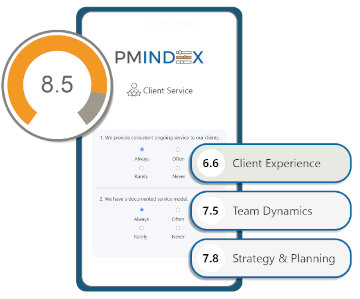

When we conduct a Gap Analysis, we remind our clients that there are three numbers that have to be dialed into the combination to unlock their full potential:

- Be a solid asset manager

- Be a solid practice manager

- Be a solid relationship manager

Our diagnostic approach reveals quickly that the advisor does in fact have a solid process and structure tied to the solutions he or she provides, but there are gaps when it comes to running the business like a business and maximizing client relationships.

Not to oversimplify it, but we often see that the advisor has done 80% of the work needed but is only seeing about 20% of his or her full potential. There is a vein of gold to be tapped into and its often easily attainable.

From Commodity to Communication

This was revealed recently in a conversation with an advisor who primarily has a B2B (Business to Business) approach as opposed to a B2C (Business to Consumer) model. This advisor provides group plans and related products to business owners and was spending a lot of time explaining his core solutions to prospective clients, but spending very little time understanding the nuances of each business nor explaining his service model and value proposition. As a result, he was swimming in a pool of sameness and had an average closing ratio. Worse than that though was that the quality and quantity of referrals he was attracting was brutal. After analyzing his communications methodology, branding and service process, I provided some minor adjustments that he could deploy. Today he spends far more time being interested in the prospective client’s business, outlining his points of difference and setting expectations as they relate to ongoing service – all driven by process. Business owners understand the importance of process and they can identify when someone is just trying make a sale versus when someone’s focused on the lifetime value of a client relationship.

Continued Success!

Contributed by Duncan MacPherson