Bringing Success to Your Succession

In our on-going consulting work, we find more and more financial advisors want to position themselves to successfully:

- Buy a practice

- Sell a practice

- Bring on a protege'

From a demographic perspective, there are three distinct groups among the many financial advisors we talk to on a regular basis. There are the 50+ advisors who are looking down the road at the eventual sale of their business. These advisors have been in the business a long time, achieved a high level of success, and are now three to five years out from transitioning to the next chapter in their lives.

Then there are the 30+ advisors who are extremely ambitious and want to light the after burner in terms of growing their respective business. But these advisors don't want to rely solely on organic growth, they want to acquire a business (or two), ideally from someone who has patiently and methodically built a durable business and is looking to exit.

And then there are the advisors somewhere in between who want to remain in the business but have a unique view on succession. Rather than sell, they want to leverage their momentum and plan for the future by grooming an associate (often a 2nd generation) or partner with an advisor (be it a junior or equal). While there is no specific timetable for succession, this advisor gets to create some scale, liberate themselves to focus solely on top clients, and create options for the future in the meantime.

Remove the Mystery

In each scenario, the key is to multiply the outcome and there are specific steps that can be taken to add precision to the process and predictability to the results.

Partnering is Not for Everyone

In the traditional partnering scenario there are countless examples of success, mediocrity and failure. The shining examples stem from an emphasis on fit and process. The also-rans stem from the fact there were few if any true synergies and the only real alignment of interest was to enhance the payout until the older partner transitioned out of the business. And the worst examples of a $500k advisor partnering with another $500k advisor and in time the combined revenue became $800k stem from a lack of preparation, incompatibility, and poor execution. 1+1 = 1.5 and with it came an increase in overhead and hassle factor.

In the case of partnering with a junior advisor, especially someone related to the lead advisor, it is essential that the protege' understand:

- Success goes beyond rates of return. Success is as much about relationship management as it is about asset management.

- Run the business like a business. Following predetermined and documented procedures creates a consistent client experience ensuring the conversion of clients to advocates.

- There are no free rides. The junior advisor needs to generate meaningful and measurable client acquisition and business development results from their own efforts.

Too many mentors leave the protege' to their own devices to figure things out. You can't play to maverick talent, you have to play to process. The most successful advisors to partner with a 2nd generation or junior created essentially a franchise-ready environment. This not only freed the mentor to focus on the top 20% of clients knowing that the 80% were well taken care of by the protege', it created an upgrade feel for clients rather than a hand-off resulting in uncovering untapped new business along the way.

There are countless examples of successes, anticlimactic outcomes and outright failures in the acquisition world too - both for the buyer and the seller. The old model simply came down to the buyer focusing on what the business would cost, while the seller was fixated on what the business was worth with very little emphasis placed on the key intrinsic and proprietary assets. There was also very little thought applied to deploying a turnkey and proven process to communicate with the clients involved prior to, during, and after the transition.

Don't Sell a Book, Sell a Business

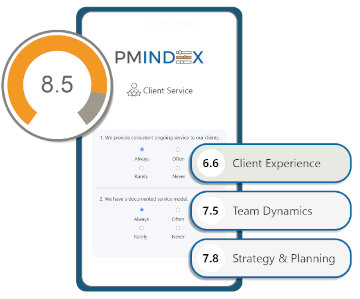

Many advisors who buy or sell a financial services practice are really only buying a book of business, not an actual business. There are several Key Performance Indicators that go beyond trailing 12. So what is the difference between a 1X transaction and a 2X or better multiplied transaction? Well clearly one of the most important issues is the quality of the client relationships. That has been proven to be just as important as the quality of their assets. How loyal are the clients based on how they have been served to this point of the relationship? Have they simply bought investments, or are they bought-in to a professional process? Metrics on empowerment, referrals, demographics and commonalities, commissions vs. fees and several other issues are key as well.

Put Time on Your Side

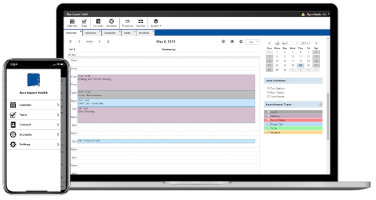

The bottom line is this, whether you plan to buy or sell a business in the future, it is essential that you get out-front and be well prepared to multiply the value of the asset and make the outcome as smooth and predictable as possible. Deploying a process demystifies the experience and ensures there is minimal opportunity leakage and that you don't squander your time.

There are More Sellers Than Buyers

As a seller, when you tighten up your business through organization and structure as well as essential best practices, you unlock hidden value in your business that differentiates you from all the others with similar aspirations. In 12 months or less you can execute a panoramic practice management process that a suitor will recognize as extremely valuable. Remember what a buyer wants; only pleasant surprises. They want the transition to be smooth, and the integration into their core business to be virtually effortless.

Acquire a Real Asset, Not Just a Collection of Assets

As a buyer, there are so many tangible and intangible issues to address in your due-diligence process. The key is to look for a business that has been built on a foundation of predictable, sustainable and duplicable processes especially as it relates to service and relationship management. Again, the quality of the relationships driven by the expectations they have and the experience they've received will have a profound impact on relationship durability and untapped potential going forward.

Many buyers in the past have acquired sketchy books thinking there was a vein of gold or all kinds of low hanging fruit just waiting to be uncovered. As a result, the buyer was fixated on the price of the acquisition rather than the quality of the asset resulting in an outcome that spiraled downward. With the benefit of hindsight came a lot of regret.

Dig Your Well Before You're Thirsty - Confucius

Remember, quality relationships last long after you paid for them. So get clarity on the issues that will impact your transaction and get organized with a plan and process. As a potential seller, the longer you wait and the less prepared you are, the less value you will get from your asset. As buyer, the longer you wait and less prepared you are, the more revenue and momentum you will forgo. In both cases, the dollars you make will be lower, but also in both cases the hassle factor and frustration will be higher. Preparation will help you squeeze more juice out of the orange.

Continued Success!