Contributed by Duncan MacPherson

What Separates the Best From the Rest?

As a coach in the financial service community, I continually ponder this very simple question:

Why are some Financial Advisors more effective than others?

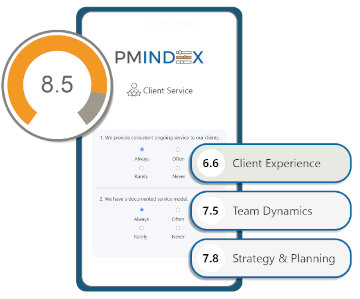

You already know that the quality of your client relationships is just as important as the quality of your advice. And while I will never trivialize the importance of providing sound financial strategies and solid investment decisions, they alone won’t guarantee success. In fact, it has been proven that there are three numbers in the combination that can unlock an advisors full potential:

- Sound investment advice

- Consistent client relationship management

- Predictable deployment of best practices

To validate this, we often scrutinize what separates the best from the rest in this business. We look at why some advisors are more successful than others and what it is they are doing that others don’t.

But what’s really fascinating is that this study transcends the financial services industry. The most successful consultants, accountants, dentists and other skilled professionals aren’t just effective at their core roles, they are also proficient at creating exceptional client experiences that lead to loyalty and refer-ability. The quality of the core deliverable is crucial, but that alone is not enough.

One of my favorite examples would have to be dentists.

First Things First

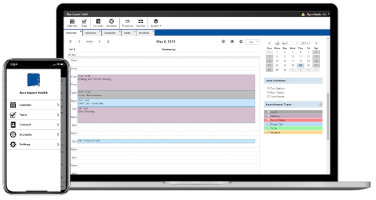

One of the most important things dentists realized was that their time is their most valuable asset. Your dentist doesn’t call you to confirm your next cleaning. Someone else does that (in fact, try to get your dentist on the phone. It’s not easy. They guard their time.). A good dentist creates organization and structure and empowers people who make $25 per hour to do $25 per hour tasks. In the process this liberates the dentist to focus on what he or she gets paid to do while creating scarcity that is attractive.

Master the Things That You Can Control

Somewhere along their specific evolutionary curve, dentists also clued into the fact that their vocation was close to the top of the list of professionals that many people despised, and then they got smart and did something about it. They started concentrating on the things that they could control. One thing they could control was preparing an environment that was so memorable and relaxing that people felt great even though they were visiting the dentist! With this historical move, dentists finally realized that they too could make use of word-of-mouth advertising! For the first time, people were talking about their dentists, and yet it wasn't in the context of pain! They were talking to their friends, families and colleagues about this special brand of 'instant rapport' that they had experienced, and it was at a dentist's office! People hearing about such things could have remarked to themselves: "I must check this out! My dentist basically uses pliers and rum!"

The other smart thing that successful dentists did was to help their patients map out a foundation for good dental health. As a part of this foundation, clients were taught that they would need regular and never-ending visits to the dentist to ensure that this strategy for good dental health was to succeed. In other words, it was an ongoing process that never ended until the patient died or lost his/her teeth. Clients are trained to empower their dentist.

Every new service provided by a dentist is communicated to clients in a forthright manner and positioned as a benefit to the client rather than as a sales opportunity. Clients become aware of their unmet needs before they even realize the need exists. And they take action.

Where is this all going? Is it such a stretch to think that we can implement the same kind of atmosphere and professional processes into the office of a financial advisor? Dentists realized at some point that the overwhelmingly negative public predisposition toward their kind was out of their control. Once they started mastering the office visit and educating their clients about the link between great dental health and how that was directly proportional to a lifelong relationship with their dentist, they have never looked back. The good dentists attract, they don’t chase.

Be Referable 365 Days a Year

Is it your fault as an advisor that the markets are volatile and the future is uncertain? Not in the least. However, if your clients tend to refer you only when things are rosy in the markets, you have a serious vulnerability in the way that you have positioned yourself with your clients. Things do not have to be this way!

If advisors would simply take a page or two from a profession that has already gone through this brand of disharmony, they would finally have a business where clients can and will refer them regardless of how the markets are doing. This is not a pipe dream. There are advisors who have already integrated these things into their businesses as we speak. These advisors have clients who have been taught the doctrine and who are not faked out by volatility. As a result, because their clients' expectations have been exceeded in the areas that the advisor can control, these advisors are immensely referable 365 days out of the year.

What's Holding You Back? Your Clients WILL Embrace This Approach!

When 'instant rapport' takes place at your office and the experience is coupled with a Client Process where the complexities of financial planning have been simplified and “future-paced”, clients will embrace your efforts. They will also realize that it would be a disservice not to recommend this five-star service to others they know who are unhappy with their financial advisors. Through a crystal-clear Client Process, clients are taught that financial planning is not an event, but a process that involves ongoing interaction with their financial advisor, repetitively and forever as their lives and needs unfold.

Like the dental mantra, clients can learn a financial mantra and will deliver it to others just as naturally and eloquently. With this kind of structure, to blame a financial advisor for an occasional or sustained hit to a balanced portfolio would be akin to blaming a dentist for your root canal.

The end result is that the 'instant rapport' and the Client Process are what the clients learn to value in dealing with the advisor instead of fixating on the rate of return on their investments.

To those advisors who doubt the veracity of this claim, the number one piece of feedback we hear from the clients of financial advisors who have embraced this approach of perfecting what they can control and improve on is:

Finally! This is what we've been waiting for!

Typically, when affluent prospective clients hear about a superior brand of advisor, they will distance themselves from the transaction-oriented advisor as quickly as possible and gravitate to the full-service advisor.

The bottom line is that everything – every action and reaction – executed by you and your team makes you either more or less refer-able. Scrutinize everything and create a refer-able experience.

Continued Success!