10 Must-Have CRM Considerations

As a financial professional who has transitioned from managing a book of business to running a full-fledged enterprise, your focus on practice and relationship management is as crucial as asset management. To truly excel in this role, having the right technology, specifically the right Customer Relationship Management (CRM) system, becomes imperative. A well-chosen CRM can streamline your operations, enhance client experiences, and help you translate your business philosophy and strategies into tangible results.

Over the years, we've engaged with financial professionals who share a business owner mindset. They deeply appreciate the philosophy and proven strategies outlined in The Advisor Playbook and The Blue Square Method. However, they seek a solution that empowers them to seamlessly translate these concepts into actions, consistently elevating the client experience they deliver. To ensure that you are effectively managing your practice and enhancing client relationships, we present the following 10 essential considerations when exploring CRM solutions:

1. Automates Best Practices

One of the most crucial aspects of a CRM for financial advisors is its ability to serve as a platform for implementing best practices within your business. To thrive in the competitive world of financial services, it's essential to have a system that not only stores client data but also guides you toward proven strategies that drive success.

A robust CRM can act as a central hub for best practices, allowing you to automate processes, track key metrics, and ensure consistency in your interactions with clients. By leveraging the power of your CRM to implement industry-proven strategies, you can elevate your client service, increase efficiency, and ultimately achieve better results. Look for a CRM that not only stores information but actively supports your journey to becoming a more effective and successful financial advisor.

2. Keeps Your Data Proprietary

You work on your business, and you understand that every investment of effort you make contributes not just to day-to-day profitability, but also to your intellectual property and enterprise value.

All of that - your best practices, client relationships and business systems - are valuable proprietary assets. They're your life's work. Your data is proprietary. Make sure your CRM keeps it that way.

3. Keep it Simple

To be candid, virtually all CRM solutions are far too complex. Feature creep is a tech term that speaks to how developers keep adding layers of functionality to a solution - features that don't address real-world needs and, instead, bog down the user.

Make sure your CRM is intuitive and easy to use, with customizable, automated procedures that balance high-tech with high-touch. Remember, technology is supposed to serve your life, not the other way around.

4. Will it Support an Automated Service Model?

The keystone to maximized, long term relationships is to segment clients and then deploy an automated service model tied to the caliber of those clients. Bookending reactive client service with a scheduled and consistent client experience is why successful business owners thrive over time.

Make sure your chosen CRM can automate those practices and keep you on track. The number one reason a client leaves a service provider is lack of consistent communication. The number one reason why a service provider hits a plateau is because they unknowingly spend 80 percent of their time reacting to the 80 percent of their clients who generate just 20 percent of the business.

A solid CRM with an automated service model will avoid those pitfalls

5. Organization, Structure and Redundancy

Your clients, and your team, crave consistency. The Rule of Three in practice management says that anything you do three or more times and has three or more steps, must be a standardized operating procedure.

Your CRM should provide your team with oversight, redundancy and accountability, because roles and responsibilities are aligned with your org chart. This ensures nothing falls through the cracks and you're not at the mercy of maverick talent who have your operating system in their heads. Instead, build and automate your procedures in your CRM

6. Achieve Professional Contrast

When you connect and interact with a prospective client, especially if they've been introduced to you by an advocate, your fit process is designed to differentiate you in a way that demonstrates how elevated you are in comparison to their soon-to-be-former provider. As the saying goes, for you to get hired, their existing provider has to get fired.

Your value is bought, not sold. Your CRM should enable you to stand out from the pack by being the most methodical and communicative. This lets you attract new clients, rather than chase them.

7. Fast Track New Clients to Advocate Status

How you start a relationship will have a profound impact on its profitability and durability, not to mention your refer-ability over the long haul.

A good CRM will enable you to effortlessly deploy a refined and optimized on-boarding process that will transition new clients to your environment and, in the process, validate their decision so they feel compelled to share their enthusiasm with friends and family members, activating referrals quickly and predictably.

8. Future Pace Relationships through FORM

As a financial professional you must have a needsbased approach to diagnose unmet needs and get out in front of evolving needs as a client's life unfolds. There was a time this was enough, but today it's a minimum requirement.

A CRM that lets you harness the power of FORM (Family, Occupation, Recreation and Money) information means your data-driven actions will ensure your clients know that you don't just care about them, you care specifically about what they care about. Don't rely on your memory, always have the most important client data at your fingertips.

9. Service & Support

The client service bar in a variety of business sectors has lowered dramatically over the years. When you reach out to call most companies today, an automated bot answers the phone, tells you that your call is important and proceeds to demonstrate that your call is not important by asking you to jump through hoops, doing everything possible to avoid actually talking to you.

Make sure your CRM provider offers real service, real onboarding and real answers when you have questions. The amount of time and money saved here can be immense.

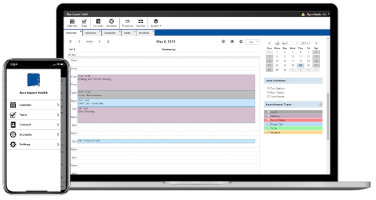

10. Streamlined Team Collaboration

In business, teamwork is vital. Look for a CRM that simplifies team collaboration. It should offer shared access to client information, task management, and real-time communication tools. This ensures everyone is on the same page, reducing miscommunication and duplicated efforts.

Efficient collaboration means smoother processes and better service for clients. It allows for a more integrated approach to client relationships, with every team member having access to the latest data and insights. Choose a CRM that strengthens teamwork, and watch your practice thrive through enhanced coordination and communication.

In your journey to elevate your financial advisory practice, choosing the right CRM is paramount. It can be the difference between a streamlined, efficient operation that delights clients and a cumbersome, time-consuming endeavor that hinders your growth

While there are various CRM options available, it's worth considering the Toolkit CRM by Pareto as one of your choices. It aligns with the vision and values of professionals who prioritize practice and relationship management. With exceptional CRM support and streamlined team collaboration, the Toolkit CRM can empower you to succeed in running your practice like a true business. So, as you explore CRM solutions, remember these ten essential considerations. Your choice will shape the way you manage your practice, foster client relationships, and ultimately, define your path to success. Choose wisely, and elevate your financial advisory practice to new heights.

Visit ToolkitCRM.com to learn more and schedule a demo today.