How to Consistently Attract IDEAL Clients

The Difference Between a Client for Life and Once in a Lifetime

Many people in business are transactional in that they sell something to a client but that may be the one and only time they do business together. Think of a car salesman, real estate agent, or the guy who sold you an air conditioner or installed your pool. There is a very good chance you will never do business with them again. Sure you might refer someone their way or you may need servicing down the road, but more than likely it will be "one-and-done".

Transactional sales people essentially trade their time for money and are always on the prowl for the next deal. Because of that, they don't need to worry too much about whether or not they like the customer they are dealing with. They simply get the deal, earn the commission and then move on. For a financial advisor though, the relationship lasts long after the initial commissions have been earned and spent. The lifetime value of a client relationship is where the real value is. This goes beyond just the recurring advisory fees or trailers. It also impacts money in motion opportunities as well as on-going referrals.

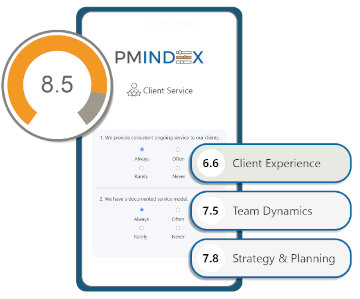

It is for that reason that having a panoramic Ideal Client Profile is essential. Now here is where it gets interesting. Virtually every advisor already has some kind of ideal client profile but they often have two or three substantial shortcomings:

- It only focuses on assets

- It is in the advisor's head

- They keep it to themselves

Be Panoramic

Many advisors create a profile that focuses on investment "minimums" and the like. The ideal client is a good fit because his or her investment needs mesh with your expertise AND because they have attitudinal qualities that are aligned with yours. Assets can change over time while attitudes are often hardened. It costs you more than it gets you to deal with a client with great assets and a lousy attitude.

Create a Checklist

Get it out of your head! It can be abstract to simply say that "I only work with nice people." List out the attitudinal qualities you are looking for. In other words, "My Ideal Client...":

- Focuses on what I am worth, not what I cost

- Sees the value in empowering me fully and exclusively

- Lives within their means

- Doesn't micro-manage

- Is responsible and accountable

- Is consistent

- Is enlightened about the ebb and flow of the markets

- Is respectful and courteous with my staff

...and on it goes.

Share it With Clients and Prospects

This checklist will give you and your staff clarity and focus in terms of sticking ardently to an Ideal Client Profile. But don't stop there, show your clients, prospective clients and partners your detailed profile during a review meeting, fit conversation, etc. The benefits of taking the abstract nature of an Ideal Client and documenting it into something people can conceptualize is powerful on many levels. New clients develop a sense of belonging and accomplishment that they are a good fit for you. They don't feel they are buying investments in a transactional way, they feel they are buying-into relationship with a professional. For partners, you become more refer-able because they feel more comfortable endorsing a consultant with a process. And you get to re-frame your value with existing clients and turn them into power brokers. They become re-acquainted with you thus increasing the quantity, and especially the quality, of people they endorse you to.

Rules of Engagement and the Power of Checklists

Airline pilots are great examples of professionals who rely on checklists. Even though they have flown hundreds of times and could probably take off and land in their sleep, they still go through a checklist to ensure nothing gets overlooked. Create a panoramic and all-encompassing Ideal Client Profile and show it to people as part of your overall process. Demonstrate that you are all things to some people and that you are methodical and deliberate in your approach. Along with the natural Law of Expectation, this process and mindset will help you predictably attract the type of clients you are looking for. Some advisors call this a self-fulfilling prophesy. I say that when you clearly establish and then communicate what you expect, you tend to attract it into your life.

Continued success!

Contributed by Duncan MacPherson