Putting Success in Succession

Are you looking toward succession in your practice? Are you dependent on a protg or partner to make all the gears mesh? Who's deciding where the ship is heading? Most importantly, will it work, both for you and your clients?

Too many mentors leave the protg to their own devices to figure these things out. You can't play to maverick talent when looking toward franchise-readiness or a partial exit; you have to play to process and to your proprietary assets.

The most successful advisors to partner with a second-generation or junior created, essentially, a franchise-ready environment. This not only freed the mentor to focus on the top 20 percent of clients, knowing that the 80 percent were well taken care of by the protg, it created the sense of an upgrade for clients, rather than feeling like they'd been handed-off, resulting in uncovering untapped new business opportunities along the way .

There are countless examples of successes, anticlimactic outcomes and outright failures in the acquisition world. The old model came down to the buyer focusing on what the business would cost, while the seller was fixated on what the business was worth with little emphasis placed on the key intrinsic and proprietary assets. There was also little thought applied to deploying a turnkey and proven process to communicate with the clients involved prior to, during, and after the transition.

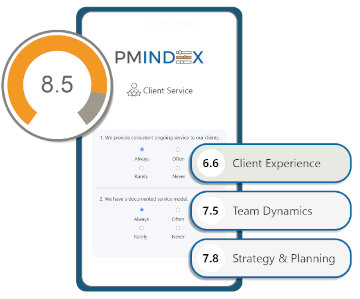

Many knowledge-for-profit professionals who buy or sell a practice are only buying a book of business, not an actual business. There are several key performance indicators that go beyond the trailing 12. So what is the difference between a 1X transaction and a 2X or better multiplied transaction?

One of the most important issues is the quality of the client relationships. That is just as important as the quantity of total assets. How loyal are the clients based on how they have been served up to this point in the relationship? Have they bought investments, or are they bought-into a professional process? Metrics on empowerment, referrals, demographics and commonalities, commissions vs. fees and several other issues are key as well. Most importantly, build a playbook that details and defines your processes so that your protg - or anyone else - can bring the service your top clients deserve and expect, and which clearly communicates to clients what they can expect from the practice.

The bottom line is this: Whether you plan to buy or sell a business in the future, it is essential that you get out front and be well-prepared to multiply the value of the asset and make the outcome as smooth and predictable as possible.

Understanding the process and communicating it clearly removes much of the friction that can occur. Deploying a process demystifies the experience and ensures there is minimal opportunity leakage - and that you don't squander your time.

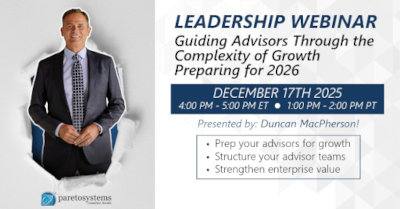

Learn more about succession on Duncan's "Always On' Podcast: paretosys.co/AODM_ep54