Building Your Brand

Financial Advisor Branding: The Key to Long-Term ROI

Advisors frequently ask me which marketing strategies are best for client acquisition. And while there is a place for some marketing strategies and campaigns, often I will steer the conversation to instead discuss the power of branding, and why it can be more effective than traditional marketing over the long haul.

Marketing is what you say to your clients, partners and prospects. Branding is what they hear. Furthermore, marketing tends to be campaign driven and doesn't have the staying power of branding which is typically on-going and part of your habits and rituals. To use the universe as a metaphor, marketing is like a shooting star - very fleeting. Branding is more of the steady burner - something that endures.

As a financial advisor you are in the knowledge for profit business. You think for a living. You aren't selling tangibles. You are promoting the promise of the future. That can be abstract and there are a lot of things out of your control. Branding helps take the abstract nature of what you do, and makes it easier to understand and appreciate.

That being said, all of your communications take time to sink in and be absorbed. Keep in mind that your MVP's (Most Valued Prospects) already have another financial provider. You are trying to position yourself as #2 and create a nagging feeling that they should consider their options. With existing clients, you want to competitor-proof those relationships, gain their full empowerment as unmet needs become apparent, and earn their endorsements. Endorsements are the distinction between a client and an advocate, but earning advocacy takes time.

Facts Tell, Stories Sell

Advocacy is created when you make it easy for your clients and partners to talk about you the messenger, not just your message. One simple example of branding is the use of coins in your client communications. I know of several advisors who now send a sterling silver dollar in a handsome case to pay tribute to a client who has referred a friend or family member. The coin is symbolic, and the client can hold it in their hands. Money and investing has become so virtual that the coin impact-fully snaps clients out of their fog and reminds them that money can be tangible and beautiful. It has immense shelf-life and anchors your relationship every time they look at it.

The Trojan Horse

Building on that, if you want to position yourself in the hearts and minds of the next generation - and throughout your clients' entire family trees for that matter - you can send your clients' children a penny beautifully framed with a reminder of the power of compounding noted on the back of the frame, as a birthday gift. You have undoubtedly seen the example of how a penny that compounds in value every day is worth over a million dollars after 30 days. It's a great metaphor to help a child understand the value of money, and the power of the rule of 72. I've heard of several examples of advisors who have made themselves indispensable to their clients and created incredible buzz throughout families, by creatively bringing value to their clients' kids when it comes to understanding money and investing. If you read The Millionaire Next Door by Tom Stanley, you already know the power of positioning yourself within the entire family.

Many of these same advisors have paper currency framed in their offices from countries ravaged by hyper-inflation. It is a conversation piece that can help you segue into a financial planning solution you provide.

Your Sense of Purpose is an Extension of Your Brand

These are just a few of the many tangible branding ideas available. They are simple and impactful but also remind you of the importance of what you do. Your legacy and purpose is tied directly to the value you bring people. The key is to inject some personality and creativity into your branding so that you aren't swimming in the pool of sameness with the countless other advisors who aren't memorable and are easy to dismiss.

Key takeaways from this article:

Branding is an investment in your future. A strong brand attracts high-value clients, fosters loyalty, and delivers sustainable ROI (Return on Investment).

Building a Strong Brand:

- Emphasize your purpose: Connect emotionally with clients by highlighting the value you bring.

- Craft a memorable identity: Inject personality and creativity into your branding.

- Deliver consistently: Exceed client expectations and ensure your brand reflects reality.

Creative Branding Strategies:

- Client appreciation gifts: Such as a tangible token like a silver dollar can strengthen client relationships.

- Family engagement: Educate children about money with age-appropriate gifts.

- Conversation starters: Use historical currency to initiate discussions about financial planning.

Continued Success!

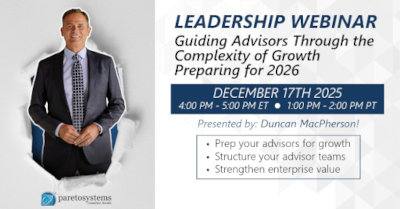

Contributed by: Duncan MacPherson, author, speaker and Financial Advisor Coach

Related Articles:

What is Branding? The Subtle Power of Branding

Would you like to implement financial advisor coaching best practices? Speak with a Pareto Systems expert to learn more about our Coaching Programs.